Visa

Using Credit Wisely

Receiving credit can be both a benefit and a curse. Prepare your learners to make wise credit choices by studying how credit influences credit scores, identifying the different components of credit cards, and exploring major consumer...

Curated OER

Extra Credit: It’s No Fairy Tale

Students discuss their knowledge of payday loans and credit cards. In this Economics lesson, students complete a read an article and Q&A activity in groups, and play a vocabulary bingo game and a quiz game on payday loans. Students...

Practical Money Skills

About Credit

It's tempting to stay away from credit cards entirely, and it can also be tempting to charge large purchases on credit cards with the intention to pay them off later. But as a three-part lesson on credit and debt shows your high...

Practical Money Skills

Understanding Credit

Help your young consumers learn about credit and the importance of credit history. With a thorough instructional activity about the ins and outs of credit, as well as the potential pitfalls of having a line of credit, kids will be...

Curated OER

Using Credit: Not for a Billion Gazillion Dollars

Fifth graders explore the concept of credit. In this consumer education lesson, the teacher uses the book Not for a Billion Gazillion Dollars to lead the class in a discussion about credit, debit, and income. Students then analyze their...

Curated OER

Charge Cards!

Students identify and define the various types of credit cards and credit card offers. In this credit cards lesson, students identify the pros and cons of managing a credit card account. Students locate information on the Federal...

Curated OER

Credit - Good? Bad?

Students examine credit cards. They explore the detrimental effects that result from debt and poor credit. Students analyze interest rates, minimum balances, and consumer debt. Students survey the benefits of credit cards.

Curated OER

Shopping for Credit Exercise

In this personal budgeting worksheet, students compare 3 credit card offers and determine which would benefit them the most. Students respond to 6 short answer questions about the exercise.

Visa

The Danger of Debt: Avoiding Financial Pitfalls

How can our perspectives of borrowing and returning influence the way we view credit? Pupils explore the concept of debt, how it impacts our ability to obtain credit, and finally the ways in which we can work to alleviate debt.

Wells Fargo

Hands on Banking

What happens to your money between the time you make a bank deposit and the time you decide to spend it? Take middle schoolers and teens through the process of opening checking and savings accounts, creating a personal budget,...

North Carolina Department of Public Instruction

What Is A Bank?

You're never too young to learn about banking and personal finance. Use a set of seven banking lessons to teach middle schoolers about checking and savings accounts, interest rates, loans and credit cards, and safety deposit boxes.

Visa

Keeping Score: Why Credit Matters

How does one get credit, and who provides credit? What is a credit score, and how can an understanding of a credit score help you to make smart financial decisions? Through discussion and worksheets, class members will identify the...

Practical Money Skills

Using Banking Services

Using a bank is a privilege and a responsibility for young consumers. Teach them the important terms and details about creating accounts, using an ATM, and maintaining a credit card.

New York City Department of Education

The Game of Life

Academics use their research skills to create a financial guidebook for young adults. They also learn about the skills needed to be successful as an adult, including how to use credit cards and how to buy a car. Hands-on activities and...

Curated OER

Credit: Taking an Interest in Credit

Students examine how credit works but looking at how credit cards and interest rates work. They use percentages to solve problems using credit card interest rates while completing a worksheets.

Curated OER

Filling Empty Pockets: Borrowing, Loans, and Credit

Students examine credit components and how each works within our economy today. For this financial literacy lesson, students explore credit terms and make decisions based on real credit card offers that they find in their on line research.

Federal Reserve Bank

Lesson 3: A Fresh Start

The members of your economics class may be busy earning graduation credits, but the credit they should be concerned about is their financial credit. The third lesson in a unit about Hurricane Katrina and other events that can result in...

Curated OER

Credit Cards: Buy Now, Pay Later

Young scholars comprehend that when they use a credit card, they are taking out a loan from the issuer of the card. They access that if a card is paid in full each month, there is no cost for using the credit card. However, if the...

Curated OER

Consumer Borrowing and Spending

Credit can be confusing for teens, some of whom are already using credit cards. Clear up misconceptions with this group research activity which has a solid outline with a lot of room to adjust to your needs and resources. Groups are...

Curated OER

EBT-rimental

Students engage in a lesson plan that gives them the tools needed to become knowledgeable credit consumers. The companion website for the ITV program TV-411 is used to provide learners with an interactive experience of what credit has to...

Federal Reserve Bank

It's Your Paycheck

Beyond reading and arithmetic, one of the most important skills for graduating seniors to have is fiscal literacy and responsibility. Start them on the right financial track with nine lessons that focus on a variety of important personal...

Curated OER

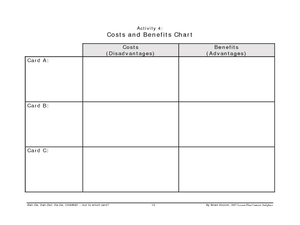

Consumer Credit

Students investigate he concept of consumer credit by explaining the benefits of using credit. The costs of their use is discussed in the lesson and the criteria that is used in order to establish credit. They work in cooperative groups...

Curated OER

Count Your Credit

Students begin the lesson by discussing credit cards, interest rates and budgets. With a partner, they complete a webquest in which they can determine the minimum payment on different amounts and interest rates on their make-believe...

Council for Economic Education

You Can BANK on This! (Part 4)

Students assess both negative and positive incentives associated with credit card use. They identify profit as an economic incentive for banks to offer credit cards.