Practical Money Skills

Understanding Credit

Help your young consumers learn about credit and the importance of credit history. With a thorough instructional activity about the ins and outs of credit, as well as the potential pitfalls of having a line of credit, kids will be...

Texas Education Agency (TEA)

Credit Scores and Your Financial Future

How important is a credit score, anyway? Scholars view a PowerPoint and take notes about credit scores. Next, they write essays explaining their plans for achieving a good credit score.

Practical Money Skills

Using Banking Services

Using a bank is a privilege and a responsibility for young consumers. Teach them the important terms and details about creating accounts, using an ATM, and maintaining a credit card.

Curated OER

Credit - Good? Bad?

Students examine credit cards. They explore the detrimental effects that result from debt and poor credit. Students analyze interest rates, minimum balances, and consumer debt. Students survey the benefits of credit cards.

Curated OER

Weigh Before You Pay: Debit or Credit?

Pupils explore the concept of debit and credit cards. In this debit and credit card lesson, students read an article about debit and credit cards. Pupils discuss differences between the two forms of payment. Students calculate the true...

Curated OER

Buying on Credit

Explore using credit in this financial responsibility and math activity. Learn to identify the acronym of "PRT" as Principle x Rate x Time, then calculate interest based on this formula. Do some real-world problem solving and choose...

PwC Financial Literacy

Credit Reports

Middle schoolers discover why it's important to establish a positive credit history and understand the value of credit reports to lenders and borrowers. They apply legal guidelines to establish the uses of a credit report other than...

Federal Reserve Bank

It's Your Paycheck

Beyond reading and arithmetic, one of the most important skills for graduating seniors to have is fiscal literacy and responsibility. Start them on the right financial track with nine lessons that focus on a variety of important personal...

Visa

The Danger of Debt: Avoiding Financial Pitfalls

How can our perspectives of borrowing and returning influence the way we view credit? Pupils explore the concept of debt, how it impacts our ability to obtain credit, and finally the ways in which we can work to alleviate debt.

Visa

Keeping Score: Why Credit Matters

How does one get credit, and who provides credit? What is a credit score, and how can an understanding of a credit score help you to make smart financial decisions? Through discussion and worksheets, class members will identify the...

North Carolina Department of Public Instruction

What Is A Bank?

You're never too young to learn about banking and personal finance. Use a set of seven banking lessons to teach middle schoolers about checking and savings accounts, interest rates, loans and credit cards, and safety deposit boxes.

Curated OER

Thinking About Credit

Students explore the concept of credit. In this credit lesson, students discuss what it means to buy items using credit. Students discuss how interest accrues and how much is really being paid with a credit card. Students calculate...

Curated OER

Filling Empty Pockets: Borrowing, Loans, and Credit

Students examine credit components and how each works within our economy today. For this financial literacy lesson, students explore credit terms and make decisions based on real credit card offers that they find in their on line research.

Curated OER

Number and Operation: All About Monday - Does it Pay?

Solve real-world financial math problems. High schoolers will work through a series of problems as they look at credit card interest, bill payment, and other real-world personal money matters.

Curated OER

Thinking About Credit

Students examine the use of credit such as installment purchases and credit cards. In this credit lesson, students learn the vocabulary associated with credit usage such as mortgage, credit report/score, and debit cards. They determine...

Curated OER

Pay Credit When Credit is Due

Students explore the concept of credit. In this credit lesson, students examine student organizers that focus on credit scores and credit history. Students participate in an on-line activity. Students examine credit card offers and...

Curated OER

Credit: Taking an Interest in Credit

Students examine how credit works but looking at how credit cards and interest rates work. They use percentages to solve problems using credit card interest rates while completing a worksheets.

Conneticut Department of Education

Personal Finance Project Resource Book

Balancing a budget, paying taxes, and buying a home may feel out of reach for your high schoolers, but in their adult years they will thank you for the early tips. A set of five lessons integrates applicable money math activities with...

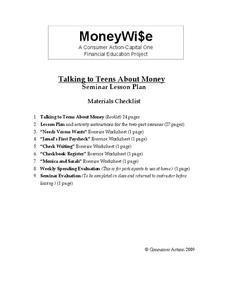

Consumer Action

Talking to Teens About Money

Your teenagers are probably very good at spending money, but how good are they at managing it? Teach class members about banking, checking accounts, interest rates, car insurance, and many other relevant concepts with a series of...

Wells Fargo

Hands on Banking

What happens to your money between the time you make a bank deposit and the time you decide to spend it? Take middle schoolers and teens through the process of opening checking and savings accounts, creating a personal budget,...

Curated OER

Credit Cards and Compound Interests-Exponential Growth

Eleventh graders investigate the way credit cards work when collecting interest. In this algebra instructional activity, 11th graders investigate the growth of interest exponentially when using a credit card. They calculate what the...

Curated OER

The Catastrophe Clan

Students participate in a financial project and identify the three c's of credit. In this credit card activity, students define and understand how to use credit wisely. Students become familiar with banking terms and types of credit. ...

Curated OER

Spending Money

Fourth graders become familiar with the ways people exchange goods and services. In this spending money lesson, 4th graders listen to a chapter from Henry and Beezus and record Henry's earnings and money spent. Students use correct...

Federal Reserve Bank

Your Credit Report

What is your credit score? How do you find it? Help your pupils answer these questions and more. They will access their free credit report and then analyze its meaning.