California Department of Education

Choosing My Lifestyle

How much does it cost to live the life your dream life? Scholars explore the pitfalls of personal finance through planning, discussion, and research. The first lesson in a five-part series tasks individuals with determining an...

Council for Economic Education

Sand Art Brownies

Which is better, Coke or Pepsi? Pupils analyze the concept of substitute goods as they investigate the choice to purchase alternate products for better prices. Fun and practical, the engaging shopping exercise helps savvy scholars get...

Council for Economic Education

Loan Amortization - Mortgage

When you buy a home for $100,000, you pay $100,000—right? On the list of important things for individuals to understand, the lesson presents the concept of interest rates and loan amortization using spreadsheets and online sources....

Council for Economic Education

Opportunity Cost

The price of those new shoes involves more than just money! Individuals explore the concept of opportunity cost using a video clip and gratification discussions. They prepare a budget based off of their set of values in regards to...

Federal Reserve Bank

Lesson 4: Back to School

Based on your current level of human capital, how long would it take you to earn $1,000,000? What about your potential human capital? Learners explore the importance of education and experience when entering the workforce, and compare...

Federal Reserve Bank

Lesson 3: A Fresh Start

The members of your economics class may be busy earning graduation credits, but the credit they should be concerned about is their financial credit. The third lesson in a unit about Hurricane Katrina and other events that can result in...

Federal Reserve Bank

Lesson 2: In the Aftermath

Don't wait for a crisis to get your finances together. An economics lesson demonstrates the importance of understanding crucial documents, banking basics, and financial tools with the focus on Hurricane Katrina in 2005 and its effects.

Federal Reserve Bank

Lesson 1: Katrina Strikes

Most families have an emergency kit in their home with flashlights, water, and extra food. But what happens to your money when disaster strikes? An economics lesson focused on the aftermath of Hurricane Katrina in 2005 demonstrates the...

DECA

Sample Exam: Personal Financial Literacy

Looking for a way to assess pupils' personal financial literacy? A 100-question, multiple-choice exam provides a good understanding of what class members already know and need to know about personal finance.

Federal Reserve Bank

Financial Literacy Infographic Scavenger Hunt

A lesson in personal finance can be the most valuable part of a high school education. Connect the basics of banking with informational reading skills in a lesson that prompts teenagers to answer a series of questions based on an array...

Visa

Hall of Fame Lesson Module — Financial Football

Kick off an engaging review on personal finance with an online football game. Financial Football incorporates both football strategies and economic knowledge in an interactive format, allowing future CFOs to answer a variety of questions...

Visa

Pro Lesson Module — Financial Football

Learners won't fumble their knowledge of personal finance after an engaging game of Financial Football! As they choose their favorite teams and desired plays, young economists demonstrate their financial literacy with a question ranging...

Visa

Rookie Lesson Module — Financial Football

Score a touchdown with an exciting game of financial football! Middle schoolers choose their favorite teams and play a virtual game of football as they answer various questions about economics.

EngageNY

The Mathematics Behind a Structured Savings Plan

Make your money work for you. Future economists learn how to apply sigma notation and how to calculate the sum of a finite geometric series. The skill is essential in determining the future value of a structured savings plan with...

Northern Ireland Curriculum

Money Wise

Does money seem to slip through your middle schoolers' fingers? Encourage them to examine spending, saving, and budgeting habits with a unit on consumer skills and money management. Young spenders study the waste that occurs with school...

EduGAINs

Making Savvy Consumer Choices

It's never too early to learn about grocery budgeting. Middle schoolers delve into the world of consumer math with a lesson that focuses on both healthy choices and real-world math applications. Groups work together to form a grocery...

Federal Reserve Bank

Cash Flow and Balance Sheets

What is your car worth? How much do you owe? Individuals create their personal cash flow and balance sheets. They learn the difference between an asset and liability using their personal information to complete the activity.

Federal Reserve Bank

Expense Tracking

Where does all your money go? Individuals keep a record of the money they spend over the course of 30 days. They then categorize where they are spending their money and write an essay detailing their findings.

North Carolina Department of Public Instruction

What Is A Bank?

You're never too young to learn about banking and personal finance. Use a set of seven banking lessons to teach middle schoolers about checking and savings accounts, interest rates, loans and credit cards, and safety deposit boxes.

Conneticut Department of Education

Personal Finance Project Resource Book

Balancing a budget, paying taxes, and buying a home may feel out of reach for your high schoolers, but in their adult years they will thank you for the early tips. A set of five lessons integrates applicable money math activities with...

Wells Fargo

Hands on Banking

Encourage middle schoolers to be proficient and knowledgeable in the economic world with a series of personal finance lessons. Focusing on banking, credit, budgets, and investing, the activities guide learners through financial literacy...

University of Missouri

Money Math

Wouldn't your class members love to become millionaires? It doesn't happen overnight. Teach young entrepreneurs about personal finance and money management with a series of lessons focused on money math. Pupils learn about banking and...

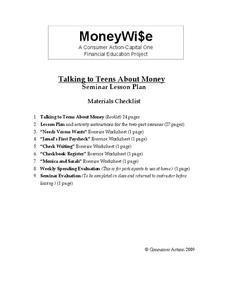

Consumer Action

Talking to Teens About Money

Your teenagers are probably very good at spending money, but how good are they at managing it? Teach class members about banking, checking accounts, interest rates, car insurance, and many other relevant concepts with a series of...

Practical Money Skills

About Credit

It's tempting to stay away from credit cards entirely, and it can also be tempting to charge large purchases on credit cards with the intention to pay them off later. But as a three-part lesson on credit and debt shows your high...