Federal Reserve Bank

Credit Cards - A Package Deal

Arm your learners with the information they will need to make smart decisions regarding credit cards and personal savings.

EngageNY

Credit Cards

Teach adolescents to use credit responsibly. The 32nd installment of a 35-part module covers how to calculate credit card payments using a geometric series. It teaches terminology and concepts necessary to understand credit card debt.

Curated OER

My Credit Card Plan

Remember all those credit card tables lined up on your college campus? So alluring and dangerous, if you don't know what you're doing. Prepare your pre-college attendees for life by offering a instructional activity on credit management....

Visa

Using Credit Wisely

Receiving credit can be both a benefit and a curse. Prepare your learners to make wise credit choices by studying how credit influences credit scores, identifying the different components of credit cards, and exploring major consumer...

Visa

Credit Cards

Choosing your first credit card can often be an intimidating and confusing experience for young adults. Give your pupils the foundational knowledge they need for tackling this process head-on, including learning to distinguish different...

PricewaterhouseCoopers

Credit and Debt: Decisions, Decisions...

Borrowing money seems like a great idea until you are in over your head. High schoolers learn the benefits and risks associated with credit and how to be a responsible borrower. More than just credit cards, they learn trustworthiness is...

Curated OER

Credit Cards: The Good, the Bad, and the ugly

Students study how dangerous credit cards can be. They see why it is important to pay off credit card bills as soon as they can. They use MS Excel to display and understand the data. They fill out questions using the data from their...

PricewaterhouseCoopers

Credit and Debt: Understanding Credit Reports and Managing Debt

Credit cards are tempting to use right out of high school. Teach your upperclassmen the benefits and challenges of credit and how it can affect their future. The lesson covers credit scores and ways to strengthen credit if learners find...

Curated OER

Money Management Part III: Savings Accounts and Cash vs. Credit

Help your class understand the importance of saving and managing their money. Here is part three to a unit on credit, cash, and savings. Learners discuss savings accounts and the idea that a budget plan can help them avoid costly credit...

Curated OER

Extra Credit: It’s No Fairy Tale

Students discuss their knowledge of payday loans and credit cards. In this Economics lesson, students complete a read an article and Q&A activity in groups, and play a vocabulary bingo game and a quiz game on payday loans. Students...

Practical Money Skills

About Credit

It's tempting to stay away from credit cards entirely, and it can also be tempting to charge large purchases on credit cards with the intention to pay them off later. But as a three-part lesson on credit and debt shows your high...

Curated OER

I want a credit card--or do I?

Students pretend to borrow $1000.00 on a credit card. They pretend to make the minimum payments for a year. When they're done, they make a pie chart showing how much of their payments reduced their debt, and how much was interest.

Curated OER

"House of Cards"

Students explore different aspects of credit card use and discover some tools to help them use credit wisely. They listen to a scenario that students might encounter once they "get out into the real world." Students are given a copy of a...

Curated OER

How Credit Card Interest Works

Students experiment with an Excel spreadsheet model that demonstrates the effects of interest on payments. They calculate actual costs, interest paid, and time necessary to pay off credit purchases and draw conclusions about the...

Federal Reserve Bank

Credit Reports—and You Thought Your Report Card Was Important

Get the facts about credit and take a close look at what factors into a consumer credit report with this fantastic lesson. Your pupils will read informational texts, read sample financial documents, and discuss the advantages and...

Curated OER

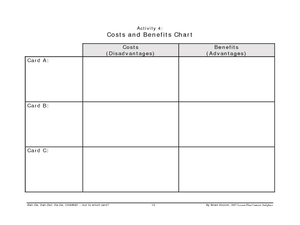

Charge Cards!

Students identify and define the various types of credit cards and credit card offers. In this credit cards lesson, students identify the pros and cons of managing a credit card account. Students locate information on the Federal...

Carolina K-12

Personal Financial Literacy: Using Credit Wisely

What is credit, and what are its advantages and disadvantages for purchases? Your class members will learn about different types of loans, such as student and mortgage, how interest factors into credit use, credit reports, and ultimately...

Visa

Credit

What are the advantages and disadvantages of having a credit card? Don't miss this important life skills and financial literacy lesson, which focuses on consumer responsibilities, creditworthiness, and establishing a credit history.

Federal Reserve Bank

Banking on Debit Cards

What are the advantages and disadvantages of using a credit card versus a debit card? What are the costs of using a debit card irresponsibly? Here you'll find a lesson on key concepts that every learner should know regarding personal...

Curated OER

Using Credit: Not for a Billion Gazillion Dollars

Fifth graders explore the concept of credit. In this consumer education lesson, the teacher uses the book Not for a Billion Gazillion Dollars to lead the class in a discussion about credit, debit, and income. Students then analyze their...

Curated OER

Credit Interview

Student determine a safe debt load. In this credit interview lesson, students explore the importance of budgeting, saving and investing. They examine the pros and cons of using a credit card. Students discuss how to build credit, apply...

Federal Reserve Bank

Lesson 3: A Fresh Start

The members of your economics class may be busy earning graduation credits, but the credit they should be concerned about is their financial credit. The third lesson in a unit about Hurricane Katrina and other events that can result in...

Texas Education Agency (TEA)

Identity Theft and Credit Safety

Deter, detect, defect. Pupils watch a PowerPoint presentation and video about identity theft and credit card safety, taking notes to use later. Next, they develop a plan for maintaining credit safety and write an essay about the topic.

Federal Reserve Bank

Keep the Currency

Each day, people throw currency away in different ways because of a lack of financial knowledge. Introduce your learners to the importance of financial literacy and assess their understanding of banking and personal finance.