Curated OER

Chapter 7: Measuring Domestic Output, National Income, and the Price Level

Young economists will enjoy this approachable and informative presentation. It is full of helpful graphs and definitions. Especially interesting will be the graph that measures the global perspective of the underground economy as a...

Curated OER

Gross Domestic Pizza

Students explore major components of gross domestic product (GDP) and how it is determined; students create and compare GDP pie charts for the countries of Pepperonia and Anchovia.

Visa

A Plan for the Future: Making a Budget

From fixed and variable expenses to gross income and net pay, break down the key terms of budgeting with your young adults and help them develop their own plans for spending and saving.

Internal Revenue Service

Module 1: Payroll Taxes and Federal Income Tax Withholding

Students complete lessons and worksheet to identify the different types and uses of payroll taxes. They examine how federal income taxes are used, determine the difference between gross and net pay, and determine how employers withhold...

Curated OER

Tax Forms and Deductions

Because many of your older students are probably getting their first jobs, it could be an appropriate time to discuss taxes. This presentation defines deductions, types of taxes, purposes of paying taxes, and the forms required to file...

Curated OER

Dream Home Mathematics

Explore the concept of budgeting with sixth graders. They will pick a career on note card made by the teacher. They then use the information on the card such as salary, expenses, and career to create a life for themselves. They also...

Curated OER

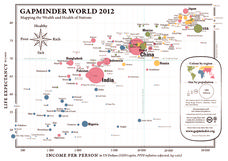

Gapminder World 2012

Here is a very interesting infographic that compares the average life expectancies, per capita incomes, and population sizes of every country in the world in 2012.

Council for Economic Education

Preparing a 1040EZ Income Tax Form

Some of us never feel like we know how to do our taxes! Help scholars understand the process early by using an informative resource. They fill out their own tax forms in a simulation activity and view multiple resources to learn even...

Texas Education Agency (TEA)

Importance of Being Accurate

Accuracy is key! Using the detailed resource, scholars practice their presicion skills, taking online spelling and typing tests. Next, they demonstrate accuracy by calculating the gross and net pay of five hypothetical employees.

Federal Reserve Bank

“W” Is for Wages, W-4 and W-2

Don't let your young adults get lost in the alphabet soup of their paychecks and federal income taxes. Using sample pay stubs and reproductions of government forms, your class members will identify the purpose of such forms as a W-4 and...

Visa

Financial Forces: Understanding Taxes and Inflation

Take the opportunity to offer your young adults some important financial wisdom on the way taxes and inflation will affect their lives in the future. Through discussion and review of different real-world scenarios provided in this...

Curated OER

Money Math: Lessons for Life

Students explore money as it applies to salary, paychecks, and taxes. In this essential mathematics lesson, students explore how math is used in various careers, how income takes are calculated and other important life lessons in math.

Curated OER

Income Statement

Students demonstrate the proper way to prepare an income statement. They calculate a company's Gross Profit, Operating Expenses, Income from Operation before tax and Net Income, then determine the company's net income or net loss during...

Curated OER

Graphing It Out

Students create bar graphs. In this graphing lesson, students explore the concepts of net pay, gross pay, income and expenses. They create a bar graph to designate financial outlay during a specified period.

Radford University

Percentages: Lesson 1

Math can be taxing at times. With a short lesson, pupils determine how income tax affects take-home pay. Learners determine their net pay based on tax tables and how adjustments in their gross pay changes the paycheck.

Curated OER

Profit and Loss

Students analyze the concept of profit and loss, the components of a simple profit and loss statement and the importance of a profit and loss statement. They calculate profits using gross income, total expenses and cost of goods sold....

Curated OER

Preparing a 1040EZ Income Tax Form

What do you do at the end of the year when your W2 arrives? File a tax form! Show learners how they to can fill out a basic 1040EZ tax form and play their part as tax paying citizens. Monetary denominations are provided for filling out...

Curated OER

Earned Income Credit

Students distinguish between tax deduction and tax credit, explain how the earned income credit affects the tax liability, apply requirements to claim the earned income credit, and describe factors that determine the amount of the earned...

Curated OER

Basic Budgeting

Students create a personal budget. For this creating a personal budget lesson, students create a list of 3 necessary things they need to survive. Students rank these things in order of importance and determine their cost. Students...

Curated OER

Taxes: Where Does Your Money Go?

Students study taxes and the role that they place in our lives. In this economic lesson, students explore the reality of taxes, how they work, why we pay them, where the money goes and how to make the most of the money you pay into taxes...

Curated OER

Places and Production

Students calculate United States GDP and GDP per capita, use a choropleth map to acquire information, and create choropleth maps of GDP per capita in South America. They identify regions with high and low GDP per capita

Curated OER

Measuring Economic Success

Pupils are introduced to the Gross Domestic Product and what this number tells us about the economy of the United States. In groups, they discuss what constitutes a healthy society and if the GDP is an accurate representation. They also...

Curated OER

The National Economy - Measures and Models

Students review economic goals and evaluate progress in achieving those goals. They focus on equity, efficiency, economic freedom and growth. They provide and example of a production decision for the economy as a whole.

Curated OER

Economics: Actions of Government

Learners examine the susceptibility of legislators to agricultural lobbyists to support subsidy programs. In small groups, they role-play as members of interest groups that might be affected by inflation.

Other popular searches

- Adjusted Gross Income

- Gross Income Salary

- Consumer Math Gross Income

- Determining Gross Income

- Calculate Gross Income