Curated OER

Dream Home Mathematics

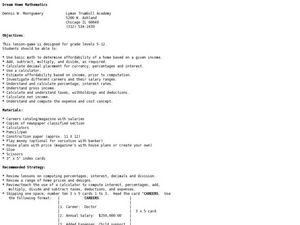

Explore the concept of budgeting with sixth graders. They will pick a career on note card made by the teacher. They then use the information on the card such as salary, expenses, and career to create a life for themselves. They also...

Curated OER

Gross Domestic Pizza

Students explore major components of gross domestic product (GDP) and how it is determined; students create and compare GDP pie charts for the countries of Pepperonia and Anchovia.

Visa

A Plan for the Future: Making a Budget

From fixed and variable expenses to gross income and net pay, break down the key terms of budgeting with your young adults and help them develop their own plans for spending and saving.

Internal Revenue Service

Module 1: Payroll Taxes and Federal Income Tax Withholding

Students complete lessons and worksheet to identify the different types and uses of payroll taxes. They examine how federal income taxes are used, determine the difference between gross and net pay, and determine how employers withhold...

Radford University

Percentages: Lesson 1

Math can be taxing at times. With a short lesson, pupils determine how income tax affects take-home pay. Learners determine their net pay based on tax tables and how adjustments in their gross pay changes the paycheck.

Visa

Financial Forces: Understanding Taxes and Inflation

Take the opportunity to offer your young adults some important financial wisdom on the way taxes and inflation will affect their lives in the future. Through discussion and review of different real-world scenarios provided in this...

Curated OER

Income Statement

Students demonstrate the proper way to prepare an income statement. They calculate a company's Gross Profit, Operating Expenses, Income from Operation before tax and Net Income, then determine the company's net income or net loss during...

Curated OER

Profit and Loss

Young scholars analyze the concept of profit and loss, the components of a simple profit and loss statement and the importance of a profit and loss statement. They calculate profits using gross income, total expenses and cost of goods...

Curated OER

Basic Budgeting

Students create a personal budget. For this creating a personal budget lesson, students create a list of 3 necessary things they need to survive. Students rank these things in order of importance and determine their cost. Students...

Curated OER

Earned Income Credit

Students distinguish between tax deduction and tax credit, explain how the earned income credit affects the tax liability, apply requirements to claim the earned income credit, and describe factors that determine the amount of the earned...

Curated OER

The National Economy - Measures and Models

Students review economic goals and evaluate progress in achieving those goals. They focus on equity, efficiency, economic freedom and growth. They provide and example of a production decision for the economy as a whole.

Curated OER

Economics: Actions of Government

Students examine the susceptibility of legislators to agricultural lobbyists to support subsidy programs. In small groups, they role-play as members of interest groups that might be affected by inflation.

Curated OER

What's in GDP?

Young scholars define GDP and collect data on a country's budget. In this economics lesson, students differentiate between real and nominal GDP. This activity contains an answer key to the activities.

Federal Reserve Bank

Dealing with the Great Depression

As part of their study of the Great Depression, young economists examine statistical data to determine the effectiveness of FDR's New Deal recovery programs.

Federal Reserve Bank

Measuring the Great Depression

Young historians examine the cost of goods and services through the Consumer Price Index (CPI), output measured by Gross Domestic Product (GDP), and unemployment measured by the unemployment rate to gain an understanding of the economic...

Curated OER

Calculating the Cost of Living

Bring Consumer Mathematics and Economics to life with this activity, where learners investigate personal finance and budgeting. They use the newspaper’s classified section to determine a future job and potential earnings and determine a...

Curated OER

Building the Aggregate Expenditures Model

A good accompaniment to an economics lesson, this presentation explores the aggregate expenditures model, detailing the relationship between consumption and saving using graphs and charts. Additional information includes investments and...

Visa

Nothing But Net: Understanding Your Take Home Pay

Introduce your young adults to the important understanding that the money they receive from their paychecks is a net amount as a result of deductions from taxes. Other topics covered include federal, state, Medicare and social security...

Curated OER

WebQuest- What is Poverty and Who Are the Poor?

Young scholars are introduced to a variety of easily accessible data about poverty. The search activity performs double-duty in exposing students to the nature and magnitude of world poverty and in confronting them with different types...

Curated OER

Math Applications 12

In this mortgages worksheet, students solve 2 different problems that include 2 or more parts to each one. First, they determine the total amount a couple will pay for their house, how much the cost is interest, and what portion of the...

Curated OER

Australia and Argentina: A Study in Contrast

Students study world events and their effect on economic growth. They research and interpret graphs to determine explanations for economic growth. Students compare the World Wars and the Great Depression to the growth of Argentina and...

Curated OER

Rent and owner's major payments

Students retrieve and map census data to determine the average rent and owners' payments made throughout Canada. They find out how many people are spending more than 30 percent of their income on housing.

Curated OER

Dependents

Students explain dependency exemption and how it affects taxable income, and apply the five dependency tests to determine whether a person can be claimed as a dependent.

PBS

Where Does Your Paycheck Go?

Upper elementary learners explore the concept of taxes taken out of an employee's paycheck. As they work through this lesson, young mathematicians discover the difference between gross pay and net pay. They also see what types of taxes...