Visa

Money Responsibility

Introduce young learners to the important life skill of responsibly managing money and recording how much they spend and save.

Visa

Savvy Spending: Sharpening Money Decisions

Do you really need that new laptop/phone/dress/jacket/etc.? Financial decisions require us to distinguish between our wants and our needs. Through discussion and the evaluation of scenarios on provided worksheets, this resource will...

Visa

A Plan for the Future: Making a Budget

From fixed and variable expenses to gross income and net pay, break down the key terms of budgeting with your young adults and help them develop their own plans for spending and saving.

Consumer Action

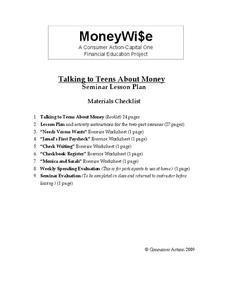

Talking to Teens About Money

Your teenagers are probably very good at spending money, but how good are they at managing it? Teach class members about banking, checking accounts, interest rates, car insurance, and many other relevant concepts with a series of...

Practical Money Skills

Making Money

Prepare your class for a life of financial literacy and stability with a unit about making money. Three lessons guides learners through the process of preparing a resume, interviewing for a job, and reading a pay stub.

Visa

Kindness Counts: Understanding Charitable Giving

Financial literacy is generally focused on personal spending and saving, but consider an opportunity to talk to your pupils about how charitable giving can also factor into money management and how it can enhance life for both oneself...

American Consumer Credit Counseling

Money Mania

Become a money maniac with a fun set of worksheets about budgeting! Kids read about how to save, earn, budget, and borrow money, and fill out their own budget and expenses.

California Department of Education

My Future Lifestyle

Mortgage, insurance, car payments...how much money will your learners need to support their desired lifestyle? Part three in a six-part college and career readiness lesson plan series tasks young job seekers with creating a monthly...

Federal Reserve Bank

Your Budget Plan

What do Whoosh and Jet Stream have in common? They are both characters in a fantastic game designed to help students identify various positive and negative spending behaviors. Through an engaging activity, worksheets, and discussion,...

University of Missouri

Money Math

Young mathematicians put their skills to the test in the real world during this four-lesson consumer math unit. Whether they are learning how compound interest can make them millionaires, calculating the cost of remodeling their bedroom,...

Visa

Money Matters: Why It Pays to Be Financially Responsible

What does it mean to be financially responsible? Pupils begin to develop the building blocks of strong financial decision making by reviewing how their past purchases are examples of cost comparing, cost-benefit analysis, and budgeting.

Visa

Earning Money

Where does money come from? Is it limitless and always available? Introduce your youngsters to the concept of earning through jobs and/or chores with a matching activity and provided worksheets.

Wells Fargo

Hands on Banking

What happens to your money between the time you make a bank deposit and the time you decide to spend it? Take middle schoolers and teens through the process of opening checking and savings accounts, creating a personal budget,...

Visa

The Tools to Build Your Financial Dream

When it comes to all the ways money management and financial responsibility weave into our daily lives as adults, make sure students are prepared to locate resources for managing their finances, such as a financial advisor.

Practical Money Skills

Buying a Home

Guide high schoolers through the process of buying a house with a simulation lesson. As pupils learn about mortgages, renting versus buying, and home inspections, they discuss ways to make informed financial decisions and sound purchases.

Federal Reserve Bank

Glo Goes Shopping

Making decisions can be very difficult. Show your class one way to evaluate choices with this lesson, which is inspired by the book Glo Goes Shopping. Learners practicing using a decision-making grid with the content of the story and a...

PricewaterhouseCoopers

Planning and Money Management: Financial Plan

More planning goes into a budget than a high schooler thinks. Here, they learn about the expected expenses and incomes, along with outside factors such as natural disasters. Learners prepare their own budget and adjust it based on the...

PricewaterhouseCoopers

Credit and Debt: Decisions, Decisions...

Borrowing money seems like a great idea until you are in over your head. High schoolers learn the benefits and risks associated with credit and how to be a responsible borrower. More than just credit cards, they learn trustworthiness is...

Virginia Department of Education

Practical Problems Involving Decimals

After discussing decimals and "going shopping" in the classroom, young mathematicians are given four practical word problems that require them to estimate their answers, given specific information. The highlight of the lesson plan is...

Curated OER

Economics Budget Project

Your class members will have the opportunity to practice the valuable skill of constructing a personal budget using real-world resources, such as a car advertisement and grocery list. They will take into consideration monthly and yearly...

Other popular searches

- Saving Spending Money

- Saving vs. Spending Money

- Saving and Spending Money

- Saving vs Spending Money

- Saving Versus Spending Money