Council for Economic Education

Preparing a 1040EZ Income Tax Form

Some of us never feel like we know how to do our taxes! Help scholars understand the process early by using an informative resource. They fill out their own tax forms in a simulation activity and view multiple resources to learn even...

Federal Reserve Bank

Income Taxes

Most adults dread April 15 — tax day! Tax preparation can be intimidating even for adults. Build confidence by leading individuals through the process and then give them a scenario to practice. The exercise uses tax vocabulary to give...

Curated OER

Preparing a 1040EZ Income Tax Form

What do you do at the end of the year when your W2 arrives? File a tax form! Show learners how they to can fill out a basic 1040EZ tax form and play their part as tax paying citizens. Monetary denominations are provided for filling out...

Internal Revenue Service

Module 1: Payroll Taxes and Federal Income Tax Withholding

Students complete lessons and worksheet to identify the different types and uses of payroll taxes. They examine how federal income taxes are used, determine the difference between gross and net pay, and determine how employers withhold...

Council for Economic Education

Tax Time Scavenger Hunt

Is a 1040EZ tax form really easy? Scholars investigate the complexities of the United States taxation system with an economics lesson. Using a wide variety of web sources, they interpret IRS taxation rules and regulations to better...

Curated OER

Progressive Reforms

Tenth graders analyze editorial cartoons focusing on progressive reform. They compare their analysis and research. Students discuss the cost of reform leading to the creation of a national income tax through the passage of the 16th...

Federal Reserve Bank

“W” Is for Wages, W-4 and W-2

Don't let your young adults get lost in the alphabet soup of their paychecks and federal income taxes. Using sample pay stubs and reproductions of government forms, your class members will identify the purpose of such forms as a W-4 and...

Curated OER

Math Skills for Everyday: Filling Out Income Tax Forms

Students accurately assess their own income taxes using actual tax forms. They read and fill out the proper forms.

Curated OER

Debate Topics and Ideas

Pupils examine both sides of arguments surrounding given debates. They use the internet and other research to collect information to support their stand on the controversial issue. Students debate their chosen topic. This lesson plans...

Visa

Financial Forces: Understanding Taxes and Inflation

Take the opportunity to offer your young adults some important financial wisdom on the way taxes and inflation will affect their lives in the future. Through discussion and review of different real-world scenarios provided in this...

Curated OER

Federal Income Tax 1040EZ Worksheet Lesson

Students practice filling out the Federal Income Tax 1040EZ tax form.

Curated OER

A Look at Individual Federal Income Tax

High schoolers investigate the concept of a personal federal income tax. They conduct research and participate in class discussion in order to deal some of the issues. They include why there is an individual income tax and how the money...

Curated OER

Good News and Bad News: Income and Taxes

Students examine Internal Revenue Service (IRS) Form 1040, citing particular line items that are pertinent to an artist acting as an entrepreneur. They explore various sources of income and the importance of keeping accurate income records.

Curated OER

Interest Income

Students identify taxable interest income, and report taxable and tax-exempt interest income.

Curated OER

Module 12-Self-Employment Income and the Self-Employment Tax

Students explain self-employment income and the self-employment tax. They distinguish between an employee and an independent contractor and explain how to compute and report self-employment profit.

Curated OER

Regressive Taxes

Students explain that regressive taxes can have different effects on different income groups. They see how a regressive tax takes a larger share of income from low-income groups than from high-income groups.

Curated OER

Dependents and Tax Credits

Students identify "count" and "non-count" nouns, and examine and discuss the Earned Income Tax Credit. They define key vocabulary words, complete various worksheets, read a newspaper article, and answer discussion questions.

Curated OER

Your First Job

High schoolers determine that they are responsible for paying income taxes through withholdings on earned income. They examine the Form W-4.

Curated OER

Taking Taxes

Students discuss the role of taxes and tax deductions in the maintence of community services. A practice W-4 form is completed by students who identify their exemptions. This lesson is intended for students acquiring English.

Curated OER

ADULT ESOL LESSON PLAN--Level 3--Obtaining Employment

Students examine and view a variety of employment facts/legalities that comes with employment in the United States including social security, income tax deductions and W-4 forms, just to mention a few.

Practical Money Skills

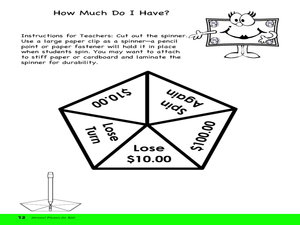

Making Money

The first step in managing your money is making money! Learn about ways to find and interview for a job with a thorough lesson on personal finances. Kids learn about the ways to earn a paycheck and then manage the funds they receive.

Curated OER

Stone Fox and Economics

Students read the novel Stone Fox and review economic concepts including income, goods, and services. They define the following terms: capital, credit, credit risk and summarize their reading by reading several chapters at a time. They...

Curated OER

Wealth

Third graders read the story The Day I Was Rich and learn about the role of money and taxes. In this money lesson plan, 3rd graders count large sums of money, group them, and give it away in the form of taxes. They discuss wealth and how...

Curated OER

Married Math

Students participate in a two-week real-life math unit. In pairs, they calculate salaries, taxes, and a budget, plan a vacation, buy insurance, make a will, and design a room. They conduct Internet research to plan the vacation, and...

Other popular searches

- Completing Income Tax Forms

- Federal Income Tax Forms

- W2 Income Tax Forms

- Filing Income Tax Forms

- India Income Tax Forms