Council for Economic Education

Preparing a 1040EZ Income Tax Form

Some of us never feel like we know how to do our taxes! Help scholars understand the process early by using an informative resource. They fill out their own tax forms in a simulation activity and view multiple resources to learn even...

Federal Reserve Bank

Income Taxes

Most adults dread April 15 — tax day! Tax preparation can be intimidating even for adults. Build confidence by leading individuals through the process and then give them a scenario to practice. The exercise uses tax vocabulary to give...

Internal Revenue Service

Module 1: Payroll Taxes and Federal Income Tax Withholding

Students complete lessons and worksheet to identify the different types and uses of payroll taxes. They examine how federal income taxes are used, determine the difference between gross and net pay, and determine how employers withhold...

Council for Economic Education

Tax Time Scavenger Hunt

Is a 1040EZ tax form really easy? Scholars investigate the complexities of the United States taxation system with an economics instructional activity. Using a wide variety of web sources, they interpret IRS taxation rules and regulations...

Federal Reserve Bank

“W” Is for Wages, W-4 and W-2

Don't let your young adults get lost in the alphabet soup of their paychecks and federal income taxes. Using sample pay stubs and reproductions of government forms, your class members will identify the purpose of such forms as a W-4 and...

Curated OER

Math Skills for Everyday: Filling Out Income Tax Forms

Students accurately assess their own income taxes using actual tax forms. They read and fill out the proper forms.

Visa

Financial Forces: Understanding Taxes and Inflation

Take the opportunity to offer your young adults some important financial wisdom on the way taxes and inflation will affect their lives in the future. Through discussion and review of different real-world scenarios provided...

Curated OER

Federal Income Tax 1040EZ Worksheet Lesson

Learners practice filling out the Federal Income Tax 1040EZ tax form.

Curated OER

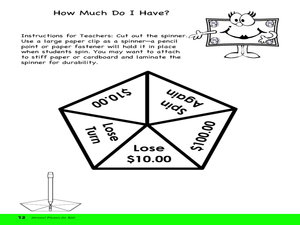

Regressive Taxes

Students explain that regressive taxes can have different effects on different income groups. They see how a regressive tax takes a larger share of income from low-income groups than from high-income groups.

Practical Money Skills

Making Money

The first step in managing your money is making money! Learn about ways to find and interview for a job with a thorough instructional activity on personal finances. Kids learn about the ways to earn a paycheck and then manage the funds...

Curated OER

Advanced Math Budget Project

What financial situations and decisions await young learners after they graduate from high school? This project allows class members to glimpse into the types of responsibilities they will have as adults, from considering job...

Curated OER

Wealth

Third graders read the story The Day I Was Rich and learn about the role of money and taxes. In this money lesson plan, 3rd graders count large sums of money, group them, and give it away in the form of taxes. They discuss wealth and how...

Curated OER

Married Math

Students participate in a two-week real-life math unit. In pairs, they calculate salaries, taxes, and a budget, plan a vacation, buy insurance, make a will, and design a room. They conduct Internet research to plan the vacation, and...

Curated OER

Budget Worksheet

In this student budget worksheet, students fill in their incomes as well as their individual payments per month to chart where their money goes each month.

Curated OER

Solving Problems Involving Percents

In this math worksheet, students solve the problems that involve the percents. Then they apply the operations to the word problems.

Curated OER

Solving Problem Involving Percents- Practice Worksheet

In this middle to high school math worksheet, students practice solving short work problems that involve percents. They solve 12 problems on the page.

Council for Economic Education

Econ Ed Link: Preparing a 1040 Ez Income Tax Form

Many students in high school or in college have part time jobs and learn the concept of gross pay and net pay. Their employers take out taxes at the federal and state level. This lesson takes a common situation and helps students...

Internal Revenue Service

Irs: Online Services and Tax Information for Individuals

In a conversational tone, the IRS answers many of the questions an individual would have when filing income tax returns for the first time. Many features are helpful even to experienced taxpayers, e.g., an IRS withholding calculator, a...

Wolters Kluwer

Small Business Guide: What Are Your Self Employment Taxes?

CCH Business Owner's Toolkit answers questions about self-employment taxes because "even if you don't hire anyone else to help you run your business, you're always going to have at least one employee, and that would be yourself."

Other

Aicpa: Taxes: u.s. Federal Government

This resource contains links to federal tax information.

Internal Revenue Service

Irs: 1040 Ez [Pdf]

This site provides help with as well as an explanation of the IRS tax form, 1040EZ.

Bankrate

Bankrate: Tax Basics, Choosing the Correct Form

Description of the 3 forms, 1040EZ. 1040A and 1040. Explains who should use each form when filing taxes and why.

Other popular searches

- Completing Income Tax Forms

- Federal Income Tax Forms

- W2 Income Tax Forms

- Filing Income Tax Forms

- India Income Tax Forms