Yummy Math

US Holiday Candy Sales

Candy is a big business! Calculate the amount of money consumers spent on major holidays—Easter, Halloween, Christmas, Hanukkah, and Valentine's Day—based on the total amount of candy sales from 2011 and the percentage of each holiday's...

Federal Reserve Bank

Lesson 3: A Fresh Start

The members of your economics class may be busy earning graduation credits, but the credit they should be concerned about is their financial credit. The third lesson in a unit about Hurricane Katrina and other events that can result in...

Curated OER

EBT-rimental

Students engage in a lesson plan that gives them the tools needed to become knowledgeable credit consumers. The companion website for the ITV program TV-411 is used to provide learners with an interactive experience of what credit has to...

Curated OER

Wise Shoppers

Students complete several activities to learn about currency and the functions of money. In this money functions lesson plan, students complete activities to learn what are the functions of money. Students calculate item prices with...

Curated OER

What is the connection between rice and estimation?

Sixth graders investigate estimating. In this estimating lesson, 6th graders estimate how much rice is eaten around the world. Students estimate the percentages of rice eaten by other countries. Students compare rice production to other...

Curated OER

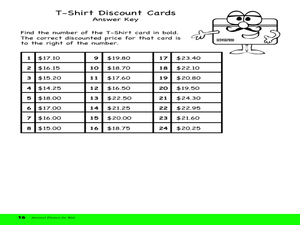

After Christmas Specials

In this math worksheet, students solve 4 story problems which pertain to after-Christmas shopping. Students will calculate prices of items on sale, figure out the best deals and solve percentage-off problems.

Curated OER

Agriculture & Alaska's Economy

Students examine Alaska's agriculture numbers from previous years. They answer questions based on Alaska's production levels.

Curated OER

Kansas vs the U.S.

Learners demonstrate an understanding of the physical and political geography of Kansas. They view maps and films to gain knowledge of Kansas. They calculate the percentage Kansas harvests for each crop out of the national total.

Curated OER

Economics: Supply, Demand & Personal Finance

In this Economics/Personal financial literacy worksheet, students use USA Today to find article, photos, charts, or graphics related to events that are affecting the prices of different products and services. Students answer questions...

Curated OER

Number of Cell phones in Use Per Household

In this cell phones worksheet, students study a bar graph of the number of cell phones usage in households. Students answer 5 questions about the graph.

Curated OER

Filling Empty Pockets: Borrowing, Loans, and Credit

Students examine credit components and how each works within our economy today. For this financial literacy lesson, students explore credit terms and make decisions based on real credit card offers that they find in their on line research.

Curated OER

Closer To the Ground Lesson 2: Providing a Helping Hand

Students examine how businesses and corporations contribute or sponsor activities for the common good. They read annual reports of major corporations to determine how they contribute to focused activities for the common good.

Curated OER

What is Taxed and Why

Students are exposed to the need for federal, state and local governments to tax constituents to provide goods and services for their residents. They identify the different kinds of taxes and give examples of the goods and services taxed.

Curated OER

The Taxpayer's Rights

Students examine rights of taxpayers and procedures the IRS uses to process tax returns

Curated OER

The Wealth Tax of 1935 and the Victory Tax of 1942

Students explain that during the Great Depression and World War II, the Roosevelt administration implemented new, broader, and more progressive taxes in order to cover the costs of the New Deal programs and the war.