Hi, what do you want to do?

Curated OER

Foundation, Nonprofit, All Matter to Me

Learners examine different types of foundations and non-for-profit organizations. They identify the focus of the different organizations. They finally relate the beginning of certain foundations or non-for-profit organizations with...

Curated OER

Maintaining Employment ESOL

Students discuss how Payroll deductions are used to pay for a variety of government services andncompany benefits. They practice reading a pay stub and writing amounts of money.

Curated OER

ESL-Reading Comprehension Activity

In this reading comprehension worksheet, students read excerpts from articles and determine whether statements made are true or false.

Curated OER

Is Capitalism Good for the Poor? | How Incentives Affect Innovation

High schoolers focus on the role played by a nation's institutions in generating creativity, invention and innovation, and analyzes how innovation promotes the economic growth that raises standards of living and alleviates poverty.

Curated OER

Inflation and Money

Students define money in terms of its functions and refer back to discussion of markets and the role of money in reducing transaction costs. They give examples of types of money.

Curated OER

Nonprofits in Our Community

Students identify nonprofit organizations within their local community. They practice using the yellow pages to locate these organizations. They use an organizer to keep all of the information they gathered organized.

Curated OER

Macroeconomic Policies

Pupils view a PowerPoint presentation on macroeconomic policies. They identify and define the main distinctions between the three key economic policies used by governments and debate their merits.

Curated OER

Gambling Sparks Battle at Civil War Site

Young scholars examine different battles of the Civil War. They discuss the proposal to put in slot machines for revenue at the battleground. They examine many key turning points of the war through an interactive program.

Curated OER

Breaking News English: Wall Street Pays Record Bonuses

For this English worksheet, students read "Wall Street Pays Record Bonuses," and then respond to 47 fill in the blank, 7 short answer, 20 matching, and 8 true or false questions about the selection.

Internal Revenue Service

Irs: Earned Income Tax Credit (Eitc)

The IRS provides a collection of articles and factsheets regarding the Earned Income Tax Credit (EITC). Content includes an overview of the EITC, the way to find out if you qualify, information for employers, law changes and more.

Cornell University

Cornell University: Law School: Income Tax Law: An Overview

A collection of resources for understanding income tax law, including its roots in the Constitution, federal and state statutes and regulations, judicial decisions, and links to the websites of government and tax agencies.

Federal Reserve Bank

Federal Reserve Bank of St. Louis: Income Taxes: Who Pays and How Much? [Pdf]

A lesson unit that teaches students all about income tax: what it is, why we have it, how taxes are structured, factors that affect one's tax bracket, and what would happen if the tax structure were changed.

American Battlefield Trust

American Battlefield Trust: Civil War: The First Income Tax

This site provides an overview of the development of the first national income tax, instituted to fund the Civil War.

Council for Economic Education

Econ Ed Link: Preparing a 1040 Ez Income Tax Form

Many learners in high school or in college have part time jobs and learn the concept of gross pay and net pay. Their employers take out taxes at the federal and state level. This lesson takes a common situation and helps students...

Internal Revenue Service

Irs: Payroll Taxes and Federal Income Tax Withholding

Employers withhold taxes from employees' pay. Gross pay is the amount the employee earns. Net pay, or take-home pay, is the amount the employee receives after deductions.

Internal Revenue Service

Irs: Income Tax Facts

This lesson plan will help young scholars understand that taxation involves a compromise of conflicting goals and that people who have the same income may not pay the same amount in taxes.

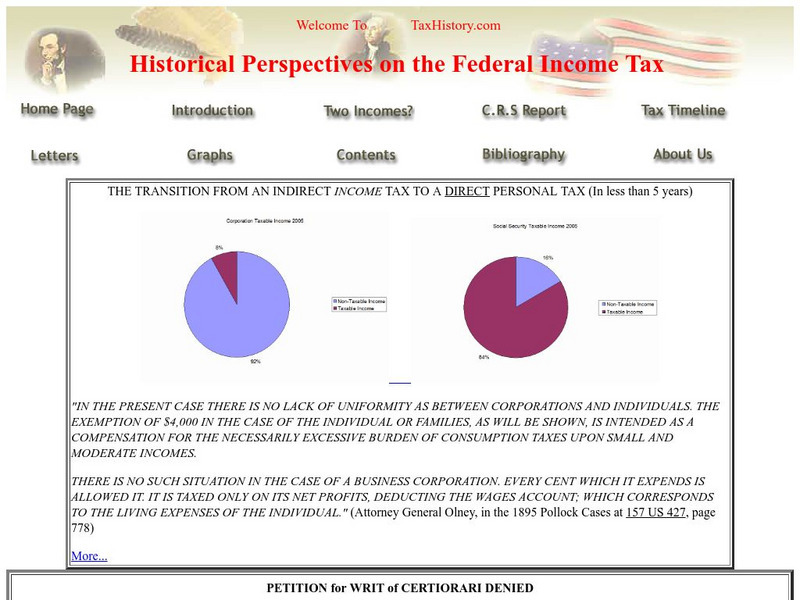

Other

Tax history.com Federal Income Tax History

TaxHistory.com provides a detailed look at the development and history of the federal income tax. Content addresses the roots of the federal income tax with the 1894 Income Tax Act, the reasoning behind the 16th amendment, the two uses...

Internal Revenue Service

Irs: Payroll Taxes and Federal Income Tax Withholding

Payroll taxes include the Social Security tax and the Medicare tax. Social Security taxes provide benefits for retired workers, the disabled, and the dependents of both. The Medicare tax is used to provide medical benefits for certain...

Internal Revenue Service

Irs: Payroll Taxes and Federal Income Tax Withholding Lesson Plan [Pdf]

This lesson will help students understand the withholding of payroll and income taxes from pay.

Internal Revenue Service

Irs: Payroll Taxes and Federal Income Tax Withholding Assessment

Answer the following multiple-choice and true/false questions about payroll taxes and federal income tax withholding by clicking on the correct answers. To assess your answers, click the Check My Answers button at the bottom of the page.

Internal Revenue Service

Irs: Payroll Taxes and Federal Income Tax Withholding Lesson Plan

This lesson plan will help students understand the withholding of payroll and income taxes from pay.

Internal Revenue Service

Irs: Income Tax Issues Lesson Plan

This lesson plan will help students understand how and why a federal income tax was implemented by Congress during the Civil War and in 1913.

Internal Revenue Service

Irs: Module 1: Payroll Taxes and Federal Income Tax Withholding

A tax tutorial that will cover payroll taxes, income tax withholding from employees' pay, and how to complete form W-4.

Consumer Financial Protection Bureau

Cfpb: Investigating Payroll Tax and Federal Income Tax Withholding

Students analyze W-4 forms and paystubs in order to better understand payroll taxes and federal income tax withholding.

Other popular searches

- Filing Income Taxes

- Income Taxes 1040ez

- Income Taxes Teachers Lesson

- U.s. Income Taxes

- Preparing Income Taxes

- Paying Income Taxes

- 1040 Ex Income Taxes

- Lessons on Income Taxes

- Personal Income Taxes

- Federal Income Taxes

- 1040 Ez Income Taxes

- Us Income Taxes

![Federal Reserve Bank of St. Louis: Income Taxes: Who Pays and How Much? [Pdf] Lesson Plan Federal Reserve Bank of St. Louis: Income Taxes: Who Pays and How Much? [Pdf] Lesson Plan](https://static.lp.lexp.cloud/images/attachment_defaults/resource/large/FPO-knovation.png)