Federal Reserve Bank

Income Taxes

Most adults dread April 15 — tax day! Tax preparation can be intimidating even for adults. Build confidence by leading individuals through the process and then give them a scenario to practice. The exercise uses tax vocabulary to give...

Council for Economic Education

Preparing a 1040EZ Income Tax Form

Some of us never feel like we know how to do our taxes! Help scholars understand the process early by using an informative resource. They fill out their own tax forms in a simulation activity and view multiple resources to learn even...

Visa

Nothing But Net: Understanding Your Take Home Pay

Introduce your young adults to the important understanding that the money they receive from their paychecks is a net amount as a result of deductions from taxes. Other topics covered include federal, state, Medicare and social...

Radford University

Percentages: Lesson 1

Math can be taxing at times. With a short instructional activity, pupils determine how income tax affects take-home pay. Learners determine their net pay based on tax tables and how adjustments in their gross pay changes the paycheck.

Curated OER

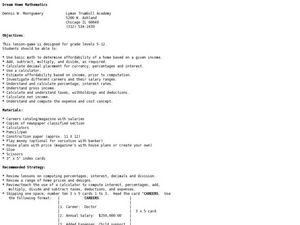

Dream Home Mathematics

Explore the concept of budgeting with sixth graders. They will pick a career on note card made by the teacher. They then use the information on the card such as salary, expenses, and career to create a life for themselves. They also...

Curated OER

Taxes: Where Does Your Money Go?

Students explore the concept of taxes. In this tax lesson, students investigate types of taxes and deductions taken out of a paycheck before they see it. Students calculate the tax on a given dollar amount. Students discuss 401(k)s...

Curated OER

Tax Problem: Percents

In this tax instructional activity, students solve 1 problem about taxes. Students find the federal and state tax on a given amount of money.

Curated OER

Taxes: Where Does Your Money Go?

Students study taxes and the role that they place in our lives. In this economic lesson, students explore the reality of taxes, how they work, why we pay them, where the money goes and how to make the most of the money you pay into taxes...

Curated OER

The Politics Of Taxation

Learners explain that taxation involves a compromise of conflicting goals and that lobbyists can influence lawmakers' decisions about taxes. They can explain why people of similar incomes often pay different tax rates and work in teams...

Practical Money Skills

Making Money

The first step in managing your money is making money! Learn about ways to find and interview for a job with a thorough instructional activity on personal finances. Kids learn about the ways to earn a paycheck and then manage the funds...

PBS

Where Does Your Paycheck Go?

Upper elementary learners explore the concept of taxes taken out of an employee's paycheck. As they work through this instructional activity, young mathematicians discover the difference between gross pay and net pay. They also...

Curated OER

Basic Budgeting

Students create a personal budget. For this creating a personal budget lesson, students create a list of 3 necessary things they need to survive. Students rank these things in order of importance and determine their...

Visa

Making Money

From evaluating the current employment market to building a resume, pupils are introduced to the wide and varied elements of career planning.

Curated OER

Financial Planning

Students research possible careers. They determine typical starting income for the career. Using collected information, students develop a budget for their starting income. Students consider car payments and research the process of...

Curated OER

The Consumer Price Index: A Measure of Inflation

Students examine inflation over the years and learn to calculate how it changes over time. In this money management instructional activity, students learn how price changes affect their purchasing power, how to come up with strategies...

Curated OER

Decimal Word Problems

In this decimals activity, students solve 10 different word problems that include using decimals. First, they determine the amount of change received from a cashier given a specific amount. Then, students write a decimal representing the...

Curated OER

Who Does the Lottery Benefit?

Students investigate the pros and cons of the lottery. In this algebra instructional activity, students use the formulas for permutation and combination to test their arguments about the lottery. They collect data about their argument...

Council for Economic Education

Econ Ed Link: Preparing a 1040 Ez Income Tax Form

Many students in high school or in college have part time jobs and learn the concept of gross pay and net pay. Their employers take out taxes at the federal and state level. This lesson takes a common situation and helps students...

Wolters Kluwer

Small Business Guide: What Are Your Self Employment Taxes?

CCH Business Owner's Toolkit answers questions about self-employment taxes because "even if you don't hire anyone else to help you run your business, you're always going to have at least one employee, and that would be yourself."