Curated OER

The Wealth Tax of 1935 and the Victory Tax of 1942

Students explain that during the Great Depression and World War II, the Roosevelt administration implemented new, broader, and more progressive taxes in order to cover the costs of the New Deal programs and the war.

Curated OER

Module 12-Self-Employment Income and the Self-Employment Tax

Students explain self-employment income and the self-employment tax. They distinguish between an employee and an independent contractor and explain how to compute and report self-employment profit.

Curated OER

Taxes: Where Does Your Money Go?

Students study taxes and the role that they place in our lives. In this economic lesson, students explore the reality of taxes, how they work, why we pay them, where the money goes and how to make the most of the money you pay into taxes...

Curated OER

Lesson 2: How Taxes Evolve

Twelfth graders examine the legislative process of enacting federal income tax laws. They conduct research and report on the Federal Migratory Waterfowl Stamp (Duck Stamp) Act of 1934.

Curated OER

Your First Job

High schoolers determine that they are responsible for paying income taxes through withholdings on earned income. They examine the Form W-4.

Curated OER

Income Statement

Students demonstrate the proper way to prepare an income statement. They calculate a company's Gross Profit, Operating Expenses, Income from Operation before tax and Net Income, then determine the company's net income or net loss during...

Curated OER

The Tax Man Cometh

Students examine websites and resources related to Bush's 2001 tax plan. They discuss the history of taxes and other tax topics. They look for evidence in the local newspaper of government spending at work.

Curated OER

Utah's Tax Situation

Students examine Utah's tax burden as relative to other states, explore types of taxes levied in Utah, including property, personal income, and sales taxes, define tax-related vocabulary, and conduct research to complete critical...

Curated OER

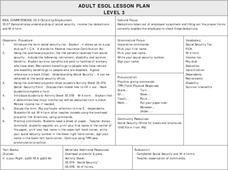

ADULT ESOL LESSON PLAN--Level 3--Obtaining Employment

Students examine and view a variety of employment facts/legalities that comes with employment in the United States including social security, income tax deductions and W-4 forms, just to mention a few.

Curated OER

Methods of Filing

Students explain the methods of filing tax returns and the advantages of preparing and transmitting tax returns electronically. They identify the return method that is most appropriate for certain taxpayers.

Curated OER

Mueller v. Allen

Young scholars investigate a First Amendment legal case involving religion, education, and reimbursement of tuition payments. They research the background of the cases and its precedents.

Curated OER

Basic Budgeting

Learners create a personal budget. In this creating a personal budget lesson, students create a list of 3 necessary things they need to survive. Learners rank these things in order of importance and determine their cost. Students...

PBS

Where Does Your Paycheck Go?

Upper elementary learners explore the concept of taxes taken out of an employee's paycheck. As they work through this activity, young mathematicians discover the difference between gross pay and net pay. They also see what types of taxes...

Council for Economic Education

Government Spending: Why Do We Spend the Way We Do?

Students examine the categories for federal spending using the internet to locate them. They create a list of expenditures noting them as government purchases or transfer payments. They analyze the patterns of spending during the past 40...

Curated OER

Married Math

Students participate in a two-week real-life math unit. In pairs, they calculate salaries, taxes, and a budget, plan a vacation, buy insurance, make a will, and design a room. They conduct Internet research to plan the vacation, and...

Curated OER

ESOL 18 Obtaining Employment

Students examine the terms social securtiy tax, social security, retirement and benefits. They respond to different commands about forms needed for employment. They practice filling out Social Security and W-4 forms.

Curated OER

Extra Practice 11: Applications With Percents

In this percent worksheet, students read short stories, determine the information needed, write an algebraic equation and evaluate the problem. Problems include simple interest, sale price, and tax rates. There are nine percent problems...

Curated OER

The Taxpayer's Rights

Students examine rights of taxpayers and procedures the IRS uses to process tax returns

Curated OER

The Taxpayer's Responsibilities

Students explore system of voluntary compliance, and describe taxpayers' responsibilities related to filing a tax return.

Curated OER

Bookkeeping 101

Students state the important questions that must be answered through the use of expense records. They design and test a method for recording business expenses.

Curated OER

Inflation and Money

Students define money in terms of its functions and refer back to discussion of markets and the role of money in reducing transaction costs. They give examples of types of money.

Curated OER

Economic Recessions

Pupils examine the characteristics of recessions and explore the role of government in encouraging business investment. They discuss why the services segment of employment has increased and list companies in their area that qualify as...

Curated OER

Demography and Services of Fairfax County, Virginia

Twelfth graders are introduced to the demographics and services of Fairfax County, Virginia. In groups, they identify programs and services that should be supported by tax dollars and presnt them to the class in a PowerPoint presentation.

National Endowment for the Humanities

Factory vs. Plantation in the North and South

North is to factory as South is to plantation—the perfect analogy for the economy that set up the Civil War! The first lesson in a series of five helps teach beginners why the economy creates a driving force for conflict. Analysis of...

Other popular searches

- Federal Income Tax 1040ez

- Federal Income Tax Forms

- Filing Federal Income Tax

- Federal Income Tax 1040ex