Curated OER

Financial Literacy - Income and Deductions

Students examine payroll process, determining ones income, deductions taken out of paychecks (taxes, insurance, charitable contributions, retirement), fixed and variable expenses to expect and money management.

Curated OER

Module 8-Tax Credit for Child and Dependent Care Expenses

Pupils explain the tax credit for child and dependent care expenses. They distinguish between a tax deduction and a tax credit. They see how the tax credit for child and dependent care expenses affects the tax liability.

Curated OER

Dependents and Tax Credits

Students identify "count" and "non-count" nouns, and examine and discuss the Earned Income Tax Credit. They define key vocabulary words, complete various worksheets, read a newspaper article, and answer discussion questions.

Texas Education Agency (TEA)

Importance of Being Accurate

Accuracy is key! Using the detailed resource, scholars practice their presicion skills, taking online spelling and typing tests. Next, they demonstrate accuracy by calculating the gross and net pay of five hypothetical employees.

Curated OER

Your First Job

High schoolers determine that they are responsible for paying income taxes through withholdings on earned income. They examine the Form W-4.

Curated OER

Income Statement

Students demonstrate the proper way to prepare an income statement. They calculate a company's Gross Profit, Operating Expenses, Income from Operation before tax and Net Income, then determine the company's net income or net loss during...

Curated OER

Earned Income Credit

Students distinguish between tax deduction and tax credit, explain how the earned income credit affects the tax liability, apply requirements to claim the earned income credit, and describe factors that determine the amount of the earned...

Curated OER

The Politics Of Taxation

Students explain that taxation involves a compromise of conflicting goals and that lobbyists can influence lawmakers' decisions about taxes. They can explain why people of similar incomes often pay different tax rates and work in teams...

Curated OER

Stone Fox

Students use the book, Stone Fox, to explore income, capital, saving, taxes, and credit. Stone Fox tells the story of Little Willy, a ten year old who enters a challenging dog-sled race in hopes of winning money to pay the back taxes on...

Curated OER

Value of Education: Education and Earning Power

Students explore the earning power of someone with a post-high school education. For this education and income lesson, students evaluate examples of occupations, their salaries, and education level needed for the job. Students calculate...

Curated OER

Lesson 2: How Taxes Evolve

Twelfth graders examine the legislative process of enacting federal income tax laws. They conduct research and report on the Federal Migratory Waterfowl Stamp (Duck Stamp) Act of 1934.

Curated OER

Utah's Tax Situation

Students examine Utah's tax burden as relative to other states, explore types of taxes levied in Utah, including property, personal income, and sales taxes, define tax-related vocabulary, and conduct research to complete critical...

Curated OER

Taxes

Students use the internet to examine the various types of taxes. Using this information, they develop a chart comparing and contrasting the types and determinations of how much tax needs to be paid. They share their charts with the...

Curated OER

Taking Taxes

Students discuss the role of taxes and tax deductions in the maintence of community services. A practice W-4 form is completed by students who identify their exemptions. This lesson is intended for students acquiring English.

Curated OER

The Tax Man Cometh

Learners examine websites and resources related to Bush's 2001 tax plan. They discuss the history of taxes and other tax topics. They look for evidence in the local newspaper of government spending at work.

Curated OER

ADULT ESOL LESSON PLAN--Level 3--Obtaining Employment

Students examine and view a variety of employment facts/legalities that comes with employment in the United States including social security, income tax deductions and W-4 forms, just to mention a few.

Curated OER

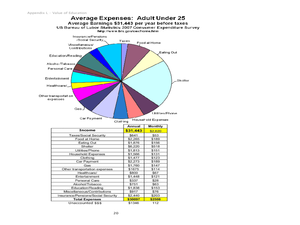

Math and Money

Students explore personal finance. In this middle school mathematics activity, students investigate banking, income tax, and the cost of living. The activity includes two bonus lessons on graphing their personal spending habits and the...

Curated OER

Methods of Filing

Students explain the methods of filing tax returns and the advantages of preparing and transmitting tax returns electronically. They identify the return method that is most appropriate for certain taxpayers.

Curated OER

Mueller v. Allen

Students investigate a First Amendment legal case involving religion, education, and reimbursement of tuition payments. They research the background of the cases and its precedents.

Practical Money Skills

Making Money

The first step in managing your money is making money! Learn about ways to find and interview for a job with a thorough lesson on personal finances. Kids learn about the ways to earn a paycheck and then manage the funds they receive.

Nebraska Department of Education

Managing My Money

Rent, food, utilities, gas, clothing, taxes! It all adds up. As part of a career planning and management unit, high school sophomores learn about financial planning and budgeting.

Curated OER

Exemptions

Students explain how exemptions affect income that is subject to tax, and determine the number of exemptions to claim on a tax return.

Curated OER

Stone Fox and Economics

Students read the novel Stone Fox and review economic concepts including income, goods, and services. They define the following terms: capital, credit, credit risk and summarize their reading by reading several chapters at a time. They...

Curated OER

Dependents

Students explain dependency exemption and how it affects taxable income, and apply the five dependency tests to determine whether a person can be claimed as a dependent.

Other popular searches

- Income Tax Form 1040ez

- Income Tax Return

- Income Tax Forms

- Federal Income Tax

- Income Tax Preparation

- Filing Income Taxes

- Income Tax Form 1040ex

- Income Tax Form 1040az

- Income Taxes 1040ez

- Earned Income Tax Credit

- Income Tax Deductions

- Income Taxes Teachers Lesson