Curated OER

How Taxing are Taxes?

Learners explore the ways that taxes are levied based on taxable income. They analyze how a new series of tax cuts might affect people of different income levels and their tax rates.

Curated OER

Paying Taxes for Chores Lesson

Students examine the concept of paying taxes with a chores theme.

Curated OER

Regressive Taxes

Students explain that regressive taxes can have different effects on different income groups. They see how a regressive tax takes a larger share of income from low-income groups than from high-income groups.

Curated OER

Taxes: Where Does Your Money Go?

Students study taxes and the role that they place in our lives. In this economic lesson, students explore the reality of taxes, how they work, why we pay them, where the money goes and how to make the most of the money you pay into taxes...

Texas Education Agency (TEA)

Importance of Being Accurate

Accuracy is key! Using the detailed resource, scholars practice their presicion skills, taking online spelling and typing tests. Next, they demonstrate accuracy by calculating the gross and net pay of five hypothetical employees.

Curated OER

Income Statement

Students demonstrate the proper way to prepare an income statement. They calculate a company's Gross Profit, Operating Expenses, Income from Operation before tax and Net Income, then determine the company's net income or net loss during...

Curated OER

The Politics Of Taxation

Students explain that taxation involves a compromise of conflicting goals and that lobbyists can influence lawmakers' decisions about taxes. They can explain why people of similar incomes often pay different tax rates and work in teams...

Curated OER

Value of Education: Education and Earning Power

Students explore the earning power of someone with a post-high school education. For this education and income lesson, students evaluate examples of occupations, their salaries, and education level needed for the job. Students calculate...

Curated OER

The Tax Man Cometh

Learners examine websites and resources related to Bush's 2001 tax plan. They discuss the history of taxes and other tax topics. They look for evidence in the local newspaper of government spending at work.

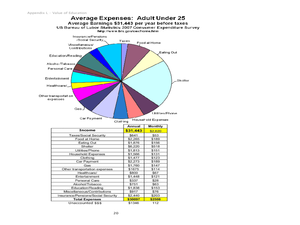

University of Missouri

Money Math

Young mathematicians put their skills to the test in the real world during this four-lesson consumer math unit. Whether they are learning how compound interest can make them millionaires, calculating the cost of remodeling their bedroom,...

Federal Reserve Bank

It's Your Paycheck

Beyond reading and arithmetic, one of the most important skills for graduating seniors to have is fiscal literacy and responsibility. Start them on the right financial track with nine lessons that focus on a variety of important personal...

Curated OER

Math and Money

Students explore personal finance. In this middle school mathematics activity, students investigate banking, income tax, and the cost of living. The activity includes two bonus lessons on graphing their personal spending habits and the...

Curated OER

Advanced Math Budget Project

What financial situations and decisions await young learners after they graduate from high school? This project allows class members to glimpse into the types of responsibilities they will have as adults, from considering job...

Practical Money Skills

Making Money

The first step in managing your money is making money! Learn about ways to find and interview for a job with a thorough lesson on personal finances. Kids learn about the ways to earn a paycheck and then manage the funds they receive.

Nebraska Department of Education

Managing My Money

Rent, food, utilities, gas, clothing, taxes! It all adds up. As part of a career planning and management unit, high school sophomores learn about financial planning and budgeting.

Curated OER

Wealth

Third graders read the story The Day I Was Rich and learn about the role of money and taxes. In this money lesson plan, 3rd graders count large sums of money, group them, and give it away in the form of taxes. They discuss wealth and how...

Curated OER

Basic Budgeting

Students create a personal budget. For this creating a personal budget lesson, students create a list of 3 necessary things they need to survive. Students rank these things in order of importance and determine their cost. Students...

PBS

Where Does Your Paycheck Go?

Upper elementary learners explore the concept of taxes taken out of an employee's paycheck. As they work through this lesson, young mathematicians discover the difference between gross pay and net pay. They also see what types of taxes...

Curated OER

Family Income

Students examine income statistics from the 2001 Census for four types of families in Canada. They appreciate the cost of running a household and the importance of tailoring expenses to match income.

Radford University

Percentages: Lessons 2 and 3

What does salary have to do with it? Working in small groups, scholars use percentages to find simple interest and the value of a car they can afford on a given salary. Learners continue on to work with salaries and calculate amounts...

Curated OER

Whole Numbers

In this whole numbers worksheet, students solve and complete 40 different word problems. First, they determine the amount of a paycheck once income tax is paid. Then, students determine the balance of an account after a deposit described...

Curated OER

Money Math: Lessons for Life

Students develop a budget for a college student using all of the influences that the student would have. In this budgeting lesson plan, students use real life examples to create a budget spreadsheet. Students read and study sample...

Sierra College

"Deals on Wheels!" Car Loan Project

Help your class members learn how to use their income wisely with a comprehensive lesson plan on calculating monthly car payments. Using basic math skills and online calculators, your learners will determine the total amount to be...

Curated OER

Math and Money

Students explore financial literacy. In this middle school mathematics lesson, students investigate income, taxes, and costs of living. Students investigate banking and use straightforward computation to learn about savings, simple...

Other popular searches

- Income Tax Form 1040ez

- Income Tax Return

- Income Tax Forms

- Federal Income Tax

- Income Tax Preparation

- Filing Income Taxes

- Income Tax Form 1040ex

- Income Tax Form 1040az

- Income Taxes 1040ez

- Earned Income Tax Credit

- Income Tax Deductions

- Income Taxes Teachers Lesson