Hi, what do you want to do?

Bartleby

Bartleby.com: American Political Writing James Otis

This site discusses the political writings of James Otis concerning the British authority to search for smuggled goods with writs of assistance. Otis argued they were the worst violation of English liberties. This site contains quotes...

Council for Economic Education

Econ Ed Link: Free Ride

Free Ride helps students identify goods and services provided by the government and evaluate the cost of government provided goods and services.

US Senate

Joint Economic Committee

The Joint Economic Committee, composed of memebers from both the United States Senate and the House of Representatives, reviews economic conditions and recommends improvements in economic policy. The content of the website includes...

Library of Congress

Loc: America's Story: Tax Day (April 15, 1913)

How did this day come to be the national day for taxes being due? What is it for? To find out the answers to these and other questions, visit this site from the Library of Congress.

Other

The History Carper: The Sugar Act of 1764 (Full Text)

The History Carper, a document and story archive, provides the full text of the Sugar Act of 1764.

Council for Economic Education

Econ Ed Link: Taxation Without Representation?

Check out this informative site to learn more about life in the colonies before the Revolutionary War. Find out why the colonists had issues with "taxation without representation." "You will work independently and in pairs to learn about...

Council for Economic Education

Econ Edlink: Taxation Without Representation?

In this teacher lesson, middle schoolers will review the series of tax acts that were enacted by the British government and disputed by the 13 colonies of America before the American Revolution. They will discuss the government- provided...

Council for Economic Education

Econ Ed Link: President Obama's Allowance

In this activity, students will identify different expenses in the US budget and will decide on the order of importance for different expenses.

Council for Economic Education

Econ Ed Link: Clean Land Thanks to Us! (Educator Page)

In this lesson about the EPA, students will find out that their government pays for goods and services by taxing people and companies.

Council for Economic Education

Econ Ed Link: Where Does the Money Come From?

With very few exceptions, the U.S. federal government does not have an "income" to spend providing goods and services. The money used for federal spending programs must be collected as federal taxes, or it must be borrowed. This lesson...

Other

Tax Analysts

Current news on tax issues in the United States. Be sure to check out their tax history Project.

Texas Education Agency

Texas Gateway: Ch. 16: Government Budgets: Key Concepts and Summary

This section provides a summary of the key concepts presented in Chapter 16: Government Budgets and Fiscal Policy from the Texas Gateway AP Macroeconomics online textbook.

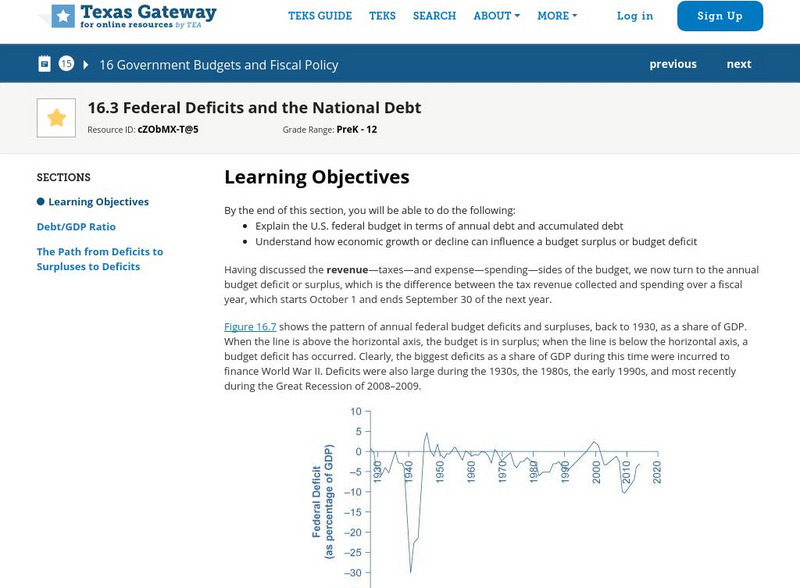

Texas Education Agency

Texas Gateway: Ch.16: Government Budgets: Federal Deficits and the National Debt

By the end of this section, you will be able to do the following: Explain the U.S. federal budget in terms of annual debt and accumulated debt and Understand how economic growth or decline can influence a budget surplus or budget deficit.

Texas Education Agency

Texas Gateway: Ch.16: Government Budgets and Fiscal Policy: Taxation

By the end of this section, you will be able to do the following: Differentiate between a regressive tax, a proportional tax, and a progressive tax and Identify the major sources of revenue for the U.S. federal budget.

Council for Economic Education

Econ Ed Link: Constitution Costs

This lesson helps students understand the basic services provided for Americans in the United States Constitution and the necessity of a system of taxation to fund those services. Students will debate the pros and cons of having...

Council for Economic Education

Econ Ed Link: Why Cities Provide Tax Breaks

Like the state and federal government, local governments offer tax incentives to businesses to help solve economic and/or environmental problems. In this lesson, young scholars will explore three different cities and determine what...

Consumer Financial Protection Bureau

Consumer Financial Protection Bureau: Investigating Taxes in Your Life

Students play a game to explore how tax revenues pay for various events and services they encounter in daily life.

Khan Academy

Khan Academy: Lesson Overview: Taxation and Deadweight Loss

This article provides an overview of Taxation and Deadweight Loss. When a tax is imposed on a market it will reduce the quantity that will be sold in the market. Whenever the quantity sold in the market is not the equilibrium quantity,...

Khan Academy

Khan Academy: Tax Incidence and Deadweight Loss

Practice what you've learned about tax incidence and deadweight loss when a tax is placed on a market in this exercise.

Consumer Financial Protection Bureau

Consumer Financial Protection Bureau: Becoming Familiar With Taxes

Learners match tax types to definitions and then apply their knowledge to tax scenarios. Includes teaching guide and student handouts.

iCivics

I Civics: Taxation

This lesson teaches the basics of taxes: what they are, who pays them, what kinds exist, and what they're used for. Students learn how people's income is taxed, how much revenue taxes generate, and how taxes and government services are...

Other

Curriculum Link: Proportional Tax Definition

This site from Curriculum Link provides a somewhat brief definition of proportional tax and provides a graph as well. A good place to get a little background information on the tax.

Curated OER

Vat Theories Progressive or Regressive Who Pays What?

Explains progressive, regressive, and proportional taxes and applies them to the value added tax (VAT).

Thomson Reuters

Find Law: Federalist Papers

Full text of the Federalist Papers which express the general views of the individuals who formed the Federalist Party. Each paper is identified by date, subject, author and place of publication and is available for reading by clicking on...