Hi, what do you want to do?

Federal Reserve Bank

The Fed - Helping Keep Banks Safe and Sound

What does an examiner look for when analyzing a bank's financial condition? In addition to learning about the 5-Cs for reviewing loans and CAMELS (capital, assets, management, earnings, liquidity, and sensitivity to risk), your learners...

Curated OER

Chinese New Year: A Simple Lesson in Debt, Percent, and Loan Interest

Students study Chinese New Year traditions while investigating the concepts of percent and loan interest. They apply the concepts to calculate the total debt on monies borrowed.

Curated OER

The Business of Credit

Learn about credit ratings and how it plays a role in the function of small businesses. Learners use their knowledge of good and bad credit to role play and determine good credit vs. bad credit in the area of small businesses.

Curated OER

Interest Word Problems

In this interest worksheet, 7th graders solve 10 different problems that include word problems and determining interest rates. First, they determine the principal paid on a certain amount of money borrowed. Then, students determine how...

Curated OER

Percents

In this percents worksheet, students solve 5 different problems that include determining various percents. First, they determine the percent of increase in population over a year. Then, students determine the sales tax of a product...

Curated OER

Who Is Considered A Good Credit Risk?

Students apply the C's of credit to evaluate who is a good credit risk. They are asked how their loaning money to friends relates to their class. Students work in groups of 4-5. They identify as many advantages and disadvantages of...

Curated OER

Lesson 3: What Happens When a Bank Makes a Loan?

Students role-play to show how bank loans made to people can have an impact on others in the community. In small groups, they analyze hypothetical loans, using flow charts or other diagrams to describe the probable impact of each.

Curated OER

VAROOOOOOMMMMMMMMMMMM!!!!!!!!!!!!!

Students simulate purchasing a car. They use various search engines on the Internet to research the car purchase. Students investigate types of cars, trade in value, insurance costs, interest rates and monthly costs.

Curated OER

Using an Amortization Table

Learners search the Internet to find a site that contains an amortization table and make a hypothesis about the results of changing time and rate. They examine the affects of time and rate on a mortgage and discuss the difference in the...

Curated OER

Who Gets the Money?

High schoolers determine the characteristics of a good loan. Using a Loan Considerations worksheet, they examine and discuss their assigned credit area and list what characteristics, as a lender, a repayable loan should have.

Monmouth College

Monmouth College: English Loan Words in Other Languages

A list of words in English which have been borrowed from other languages. Includes the languages of Italian, French, German, and Japanese.

Other

How to Avoid Foreclosure

Advice from the U.S. Department of Housing and Urban Development on avoiding foreclosure.

Federal Reserve Bank

Federal Reserve Bank of Philadelphia: Understand & Improve Your Credit Score

Find out how your credit score is figured, why it is important to keep a high credit score, and some tips on how to keep your rating high.

Federal Reserve Bank

Federal Reserve Bank of Philadelphia: What Your Credit Report Says About You

Find out why your credit report is so important to your well-being in today's economy. See where the reports come from, who can see your credit report, what type of information is on it, as well as other important facts about credit scores.

Other

Pine Tree Legal: Legal Guide for Immigrants: Housing

Comprehensive, easy-to-understand explanation in English and Spanish of how to acquire housing in the United States. Legal issues associated with buying or renting a residence are also presented. Though the site caters to immigrants to...

US Department of Education

Us Department of Education: Explore Financial Aid

This site from the US Department of Education provides this comprehensive government publication on grants, loans, and work-study programs. Each piece of information can be accessed by clicking on the corresponding link.

Consumer Financial Protection Bureau

Consumer Financial Protection Bureau: Paying for College

A website dedicated to helping students make informed financial decisions through their road to college. Website focues on filling out financial aid to choosing a loan.

Council for Economic Education

Econ Ed Link: Calculating Simple Interest

How do banks calculate the amount of interest paid on a loan? In this lesson, students will view a Livescribe Pencast to learn how to find the dollar amount in interest that is due at maturity. This lesson uses different time periods...

Khan Academy

Khan Academy: Lesson Summary: The Market for Loanable Funds

This video lesson from Khan Academy covers the financial market for loanable funds. This resource is designed as a review for the AP Macroeconomics Test or college-level economics cours.

Khan Academy

Khan Academy: Public Service Loan Forgiveness: A Path Out of Student Debt

If you're employed by the government or certain types of non-profits, you may qualify for student loan forgiveness through the Public Service Loan Forgiveness program. Learn more about what it takes to qualify and common pitfalls to avoid.

Cornell University

Cornell University: Law School: Consumer Credit Overview

Resource provides an overview of what consumer credit is. It gives several examples of consumer credit such as credit cards, loans, and mortgages.

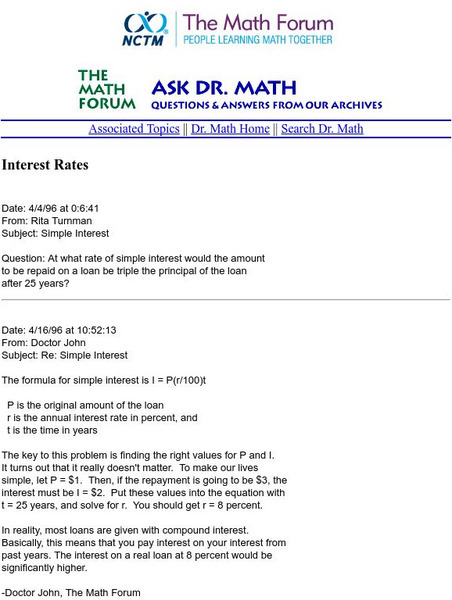

National Council of Teachers of Mathematics

The Math Forum: Interest Rates

This Dr. Math site asks about simple interest and its effect on the repayment of a loan.