Hi, what do you want to do?

PBS

Pbs: Frontline: The [Credit] Card Game

Information and analysis on the practices of the loan industry in America. Focus is on the wave of financial services legislation, which attempts to curb abusive tactics of banks and credit card issuers, that came into effect in 2010.

Save And Invest

Finra Investor Education Foundation: Before You Choose a Credit Card

This lesson plan covers the differences between credit cards and how to choose the right one.

Digital History

Digital History: Reaganomics

This on "Reaganomics," President Reagan's economic policy during his two presidential terms in the 1980s, discusses his laissez-faire approach and tax-cutting, which contributed to the economic recovery of that period.

Texas Instruments

Texas Instruments: Bonds and Bond Yield to Maturity

In this activity, students will deal with Bonds, that are long-term promissory notes, specifying that the creditor will receive regular interest payments for the term of the agreement and then receive the face amount of the bond....

Texas Instruments

Texas Instruments: Buying a Car

Students will explore various financial aspects of buying a car including calculating interest rates, payments, and total cost of the car over time.

Texas Instruments

Texas Instruments: Math Today for Ti Navigator System Home Sales Records

Many young people choose to buy their own homes, rather than rent them. Most will have to take out a home mortgage in order to fulfill this dream. If they plan to buy a home in the future, they will need to think about: How much does it...

TED Talks

Ted: Ted Ed: The Time Value of Money

We've all heard the phrase "Time is money." But what do these two things actually have to do with one another? German Nande explains the math behind interest rates, revealing the equation that will allow you to calculate the future value...

Other

Financial Pipeline: Forecasting Interest Rates

Discusses the extent to which monetary policy, loose or tight, influences interest rates. Also discusses inflation and demand for capital as important for interest rates.

Other

Economic Awareness Council: Credit Control [Pdf]

Learn about responsible use of credit and credit cards, your credit score and why it is important, and how to get out of debt if you've already overextended your finances.

Other

Business Week: Alan Greenspan's Brave New World

This 1997 article covers Alan Greenspan's career and analyzes the economic climate (past, present, and projected future) during the boom years of the 1990s.

Other

Federal Reserve Bank of Kansas City: The Federal Reserve System

The site maintained by the Federal Reserve District explains monetary policy, and supervisory and regulatory role of the U.S. Federal Reserve System.

Other

Pension Benefit Guaranty Corporation

A federal government corporation that protects the pension benefits of 43 million Americans. Search the online directory for missing participants. Pension publications too.

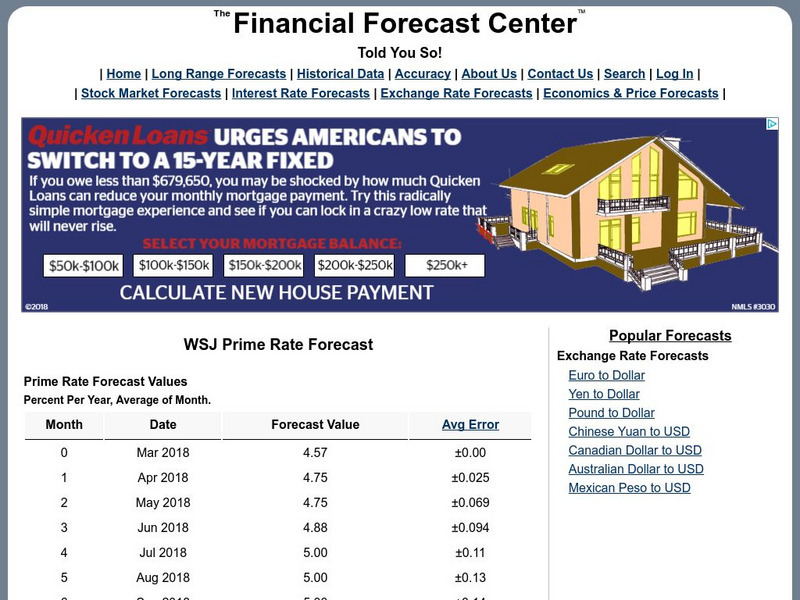

Other

Financial Forecast Center: Prime Loan Interest Rate Forecast

See the forecast of prime loan interest rates over the next six months and read a graph showing its recent history.

Council for Economic Education

Econ Ed Link: Big Banks, Piggy Banks

Use this informative economics lesson plan. Find out how to save your money. "You will read about safe places for keeping money; you also will learn about places where money can earn money."

Illustrative Mathematics

Illustrative Mathematics: F Le Interesting Interest Rates

For this task, students work with simple and compound interest rates to determine which bank offers the best return on a deposit. Aligns with F-LE.A.1.

Council for Economic Education

Econ Ed Link: A Penny Saved Is a Penny at 4.7% Earned

This is a instructional activity from EconEdLink where students learn about saving money. Includes activities and materials.

Other

Prime Rate: Rate, Definition, Historical Graph

Find a graph and chart showing the historical prime interest rate from 1998 to the present.

Council for Economic Education

Econ Ed Link: The Economics of Homebuying

This lesson analyzes the costs and benefits of homeownership and asks the student to describe the factors that affect affordability, use cost-benefit analysis and knowledge of home-buying procedures to reduce the costs, analyze the...

Alabama Learning Exchange

Alex: How Much Does It Cost?

Students will use an online mortgage calculator to determine the cost of financing a house over various lengths of time and at various interest rates. This lesson is excellent to include in a budgeting unit.

Practical Money Skills

Practical Money Skills: Monetary Policy

Learn about monetary policy, the steps the central bank of a nation can take in order to regulate the nation's money supply.

Khan Academy

Khan Academy: Lesson Summary: Nominal vs. Real Interest Rates

This information is intended for AP Macroeconomics young scholars or for those taking college macroeconomics. This lesson is a summary review of key terms and calculations related to the distinction between the real interest rate and the...

Khan Academy

Khan Academy: Real Interest Rates and International Capital Flows

Practice what you've learned about differences in real interest rates affect the movement of financial capital between countries. In this exercise, you'll get practice synthesizing many of the models you have seen so far to better...

Khan Academy

Khan Academy: Nominal vs. Real Interest Rates

Practice what you've learned about the distinction between the nominal interest rate and the real interest rate, as well as how to calculate both of these key measures.

Khan Academy

Khan Academy: Real Interest Rates and International Capital Flows

In this lesson summary review and remind yourself of the key terms and graphs related to how relative differences in real interest rates change the flow of assets between countries. This resource is designed as a review for the AP...

![Pbs: Frontline: The [Credit] Card Game Activity Pbs: Frontline: The [Credit] Card Game Activity](https://content.lessonplanet.com/knovation/original/485357-9c79222bfad54d7b497f15c394b1bb12.jpg?1661520669)