Texas Education Agency

Texas Gateway: Ch. 16: Government Budgets: Critical Thinking Questions

This section provides study questions that require critical thinking bases on the content of Chapter 16: Government Budgets and Fiscal Policy from the Texas Gateway AP Macroeconomics online textbook.

Texas Education Agency

Texas Gateway: Ch. 16: Government Budgets and Fiscal Policy: Review Questions

This section provides review study questions covering the content of Ch. 16: Government Budgets and Fiscal Policy from the Texas Gateway AP Macroeconomics online textbook.

Texas Education Agency

Texas Gateway: Ch.16: Government Budgets and Fiscal Policy: Self Check Questions

This section provides self-check study questions covering the content of Ch. 16: Government Budgets and Fiscal Policy from the Texas Gateway AP Macroeconomics online textbook.

Texas Education Agency

Texas Gateway: Ch. 16: Government Budgets and Fiscal Policy: Key Terms

This is a list of key terms and definitions used in Ch. 16: Government Budgets and Fiscal Policy from the Texas Gateway AP Macroeconomics online textbook.

Other

U.s. Department of Labor: The Federal Budget Process

The Federal Government budgeting process is described. The link called "STEPS" further describes the budget process.

Texas Education Agency

Texas Gateway: Ch. 16: Government Budgets: Key Concepts and Summary

This section provides a summary of the key concepts presented in Chapter 16: Government Budgets and Fiscal Policy from the Texas Gateway AP Macroeconomics online textbook.

Council for Economic Education

Econ Ed Link: The Role of Government: The Federal Government and Fiscal Policy

Students will visit "A Citizen's Guide to the Federal Budget" and use the federal government website to obtain information which will help them understand basic information about the budget of the United States Government for the current...

Texas Education Agency

Texas Gateway: Ch.16: Government Budgets and Fiscal Policy: Government Spending

By the end of this section, you will be able to do the following: Identify U.S. budget deficit and surplus trends over the past five decades and Explain the differences between the U.S. federal budget, and state and local budgets.

Texas Education Agency

Texas Gateway: Ch. 16: Government Budgets and Fiscal Policy: Problems

This section provides three problems based to solve based on the content of Ch. 16: Government Budgets and Fiscal Policy from the Texas Gateway AP Macroeconomics online textbook.

Texas Education Agency

Texas Gateway: Ch. 16: Government Budgets & Fiscal Policy: Automatic Stabilizers

By the end of this section, you will be able to do the following: Describe how discretionary fiscal policy can be used by the federal government to stabilize the economy, Identify examples of automatic stabilizers, and Understand how a...

Texas Education Agency

Texas Gateway: Ch. 16: Government Budgets: The Question of a Balanced Budget

By the end of this section, you will be able to do the following: Understand the arguments for and against requiring the U.S. federal budget to be balanced and Consider the long-run and short-run effects of a federal budget deficit.

Texas Education Agency

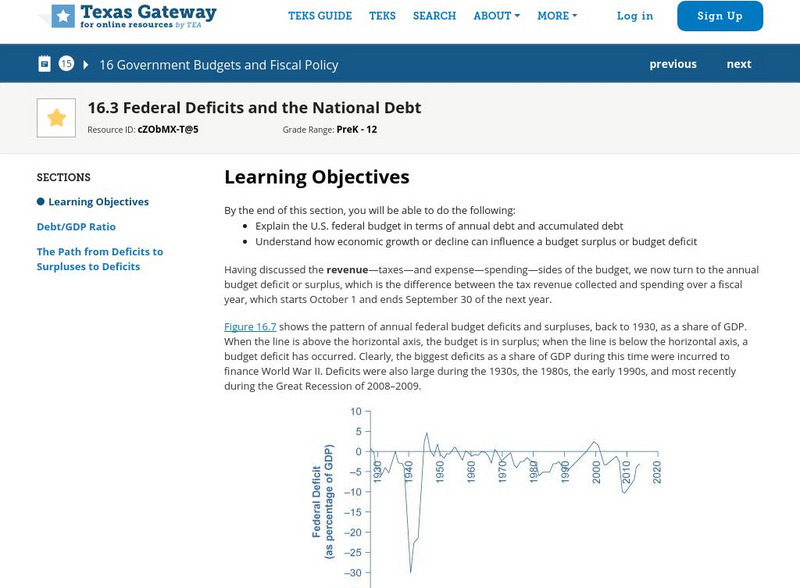

Texas Gateway: Ch.16: Government Budgets: Federal Deficits and the National Debt

By the end of this section, you will be able to do the following: Explain the U.S. federal budget in terms of annual debt and accumulated debt and Understand how economic growth or decline can influence a budget surplus or budget deficit.

Constitutional Rights Foundation

Constitutional Rights Foundation: Proposed Changes in the Way the Federal Government Operates

Examine amendments made to aid the government in balancing the budget and income tax as well as the debate over term limits.

Texas Education Agency

Texas Gateway: Ch.16: Government Budgets and Fiscal Policy: Taxation

By the end of this section, you will be able to do the following: Differentiate between a regressive tax, a proportional tax, and a progressive tax and Identify the major sources of revenue for the U.S. federal budget.

US National Archives

Docsteach: The School Lunch Program and the Federal Government

Students will draw upon the visual and textual data presented in photographs and documents to gain an understanding of how the federal school lunch program is a direct result of the Great Depression, how it became a permanent part of the...

Indiana University

The Center on Congress: E Learning Module: Federal Budget Allocation

Interactive learning activity teaches how Congress allocates funds in the federal budget for programs such as Homeland Security, Defense, and Education.

iCivics

I Civics: Government Spending

This lesson plan focuses on a variety of topics related to government spending, including the federal budget, mandatory versus discretionary spending, and government debt.

C-SPAN

C Span Classroom: Teaching About Balanced Budget Amendment

Learning resource using C-SPAN videos and related articles from which students learn what a balanced budget amendment is and whether it's a good idea for the country or not. Students join the debate by participating in a deliberation in...

Texas Education Agency

Texas Gateway: Ch.16: Introduction to Government Budgets and Old Address

In this chapter, you will learn about the following: Government spending; Taxation; Federal deficits and national debt; Using fiscal policy to fight recessions, unemployment, and inflation; Automatic stabilizers; Practical problems with...

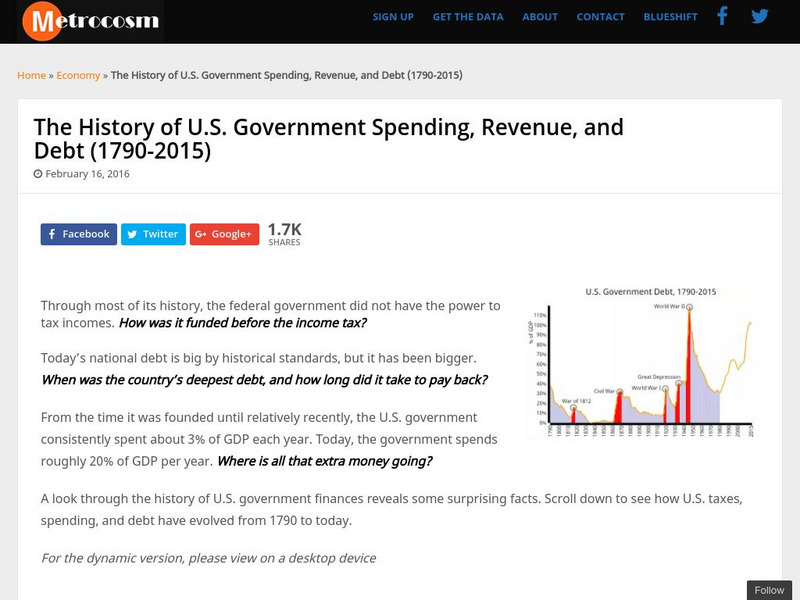

Other

Metrocosm: The History of u.s. Government Spending, Revenue, and Debt

The amount of national debt is a hot button issue today. Compare our current national budget to years past to see when our country was in our deepest debt. By analyzing the following charts, students will see the evolution of U.S....

US Government Publishing Office

Ben's Guide to u.s. Government: Branches of Government: The President's Budget

Ben's Guide is a fun way to present US laws to students. This site presents an explanation of the Presidential Budget. Links to related sites are available.

University of Groningen

American History: Outlines: The Federal Budget

Overview on the complexities of the federal budgeting process and the Congressional Budget Office (CBO).

Other

Government of Canada: Budget 2009: Canada's Economic Action Plan

The budget for 2009, announced by the Honourable Jim Flaherty, Minister of Finance, is summarized. The Economic Action Plan for Canada provides almost $30 billion in support to the Canadian economy which is equivalent to 1.9 percent of...

University of Groningen

American History: Outlines: Government in the Economy

This resource shows the different roles that the government plays in relation to the economy. It talks about the federal budget, the different responsibilities the government has, federal efforts to control monopolies, government...