Federal Reserve Bank

Gini in a Bottle: Some Facts on Income Inequality

Delve into the hard numbers and fundamental concept of income inequality in the United States, using graphs, detailed reading materials, and an organized learning exercise.

PricewaterhouseCoopers

Buying a Home: Income vs. Monthly Payments

Purchasing a house takes more plan than elementary schoolers realize. Each buyer will look at monthly income to determine what they can afford for a mortgage and other expenses.

ProCon

Universal Basic Income

Should the United States adopt a universal basic income? After reading brief background information, scholars research the debate topic by reviewing the top three pros and cons. They also respond to a survey question and review other...

Federal Reserve Bank

U.S. Income Inequality: It's Not So Bad

What is the difference between a flat tax, progressive tax, tax deduction and transfer payments? Pupils examine the ability-to-pay principle of taxation through discussion, problem solving, and a variety of worksheets on topics from US...

Curated OER

Income and Expenses

Students discuss income and expenses. For this lesson on money, students define income and expenses, after whith they keep track of their income and expense transactions on a basic ledger.

Curated OER

Income and Outcomes

Bring financial literacy into your classroom. Learners use peer support to reflect on their spending and how it reflects their income and their values.

Federal Reserve Bank

Invest in Yourself

What are the different ways that people can invest in their human capital for a better future? Pupils participate in an engaging hands-on activity and analyze data regarding unemployment, the ability to obtain an education, and median...

Curated OER

Chapter 34: Income Inequality and Poverty

Displaying the causes, trends, and effects of income inequality, this presentation covers the wide gap between wealth and poverty in the United States. The navigational tool will help lecturers guide the conversation. The key terms in...

Curated OER

Chapter 7: Measuring Domestic Output, National Income, and the Price Level

Young economists will enjoy this approachable and informative presentation. It is full of helpful graphs and definitions. Especially interesting will be the graph that measures the global perspective of the underground economy as a...

Council for Economic Education

The Economics of Income: If You’re So Smart, Why Aren't You Rich?

If basketball players make more than teachers, why shouldn't learners all aspire to play in the NBA? Unraveling the cost and benefits of education and future economic success can be tricky. Economic data, real-life cases, and some...

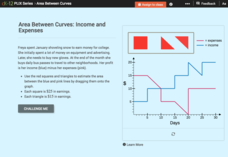

CK-12 Foundation

Area Between Curves: Income and Expenses

Use the area of polygons to calculate the area between curves. Pupils calculate areas under income and expense curves by filling the space with squares and right triangles. Using that information, they determine the profit related to the...

Internal Revenue Service

Module 1: Payroll Taxes and Federal Income Tax Withholding

Students complete lessons and worksheet to identify the different types and uses of payroll taxes. They examine how federal income taxes are used, determine the difference between gross and net pay, and determine how employers withhold...

Curated OER

My Monthly Budget

Here's a nice layout to work on a monthly budget. There's a section to write income: where it comes from, the amounts, and any other notes. Then there's a section to write about expenses: what is purchased, the amount it costs, and...

Curated OER

Budget Mania

Young scholars examine several examples of budgets to develop a facility with the components of its formation. Income, expenses, and expenditures are considered and itemized for this lesson.

Curated OER

Progressive Reforms

Tenth graders analyze editorial cartoons focusing on progressive reform. They compare their analysis and research. Students discuss the cost of reform leading to the creation of a national income tax through the passage of the 16th...

Federal Reserve Bank

Journey to Jo’burg: A South African Story

How did South African apartheid affect the ability of people of color to increase their human capital? Here is a rich lesson in which learners come to understand the relationship between investment in human capital and income, while also...

Curated OER

Race, Education, and Income: Comparing Carter & Reagan

High school learners compare economic outcomes for 3 racial groups under the presidencies of Jimmy Carter and Ronald Reagan by analyzing a series of graphs, answering questions from a worksheet, and participating in a discussion.

Council for Economic Education

Preparing a 1040EZ Income Tax Form

Some of us never feel like we know how to do our taxes! Help scholars understand the process early by using an informative resource. They fill out their own tax forms in a simulation activity and view multiple resources to learn even...

Federal Reserve Bank

Income Taxes

Most adults dread April 15 — tax day! Tax preparation can be intimidating even for adults. Build confidence by leading individuals through the process and then give them a scenario to practice. The exercise uses tax vocabulary to give...

EngageNY

Federal Income Tax

Introduce your class to the federal tax system through an algebraic lens. This resource asks pupils to examine the variable structure of the tax system based on income. Young accountants use equations, expressions, and inequalities to...

Curated OER

Earning an Income

Fourth graders study the role of money in society and define how to earn an income. In this human capital lesson, 4th graders read the book Shoeshine Girl and discuss it. Students discuss various economic concepts and complete the...

Curated OER

Corporate Tax Rate and Jobs

Does lowering the corporate tax rate help create jobs in the United States? Learners explore the top pro and con arguments and quotes relating to the issue. They read background information about the creation of the federal corporate...

Curated OER

Good News and Bad News: Income and Taxes

Students examine Internal Revenue Service (IRS) Form 1040, citing particular line items that are pertinent to an artist acting as an entrepreneur. They explore various sources of income and the importance of keeping accurate income records.

Curated OER

Financial Literacy - Income and Deductions

Students examine payroll process, determining ones income, deductions taken out of paychecks (taxes, insurance, charitable contributions, retirement), fixed and variable expenses to expect and money management.

Other popular searches

- Net Pay

- Income Tax Form 1040ez

- Income Taxes

- Income Statement

- Income Tax Return

- Gross Income

- Expenses and Incomes

- Income Tax Forms

- Disposable Income

- High Income

- Income Inequality

- Earned Income