Curated OER

Calculating Sales Tax

Observe and demonstrate how to calculate state sales taxes. Learners create a sales tax chart by calculating the sales tax amount and tax inclusive retail price for school store items, then calculate the subtotals, sales tax amounts, and...

Curated OER

The Five W's of Tax Day

Use April 15th to teach your students the fundamentals of the American federal tax system.

Curated OER

Understanding the Bush Tax Cut Plan

The class examines the new tax cut plan proposed by President Bush. They practice calculating income tax rates and interpreting the data. Then they research topics that are of interest to them related to taxes.

Federal Reserve Bank

Income Taxes

Most adults dread April 15 — tax day! Tax preparation can be intimidating even for adults. Build confidence by leading individuals through the process and then give them a scenario to practice. The exercise uses tax vocabulary to give...

Federal Reserve Bank

Government Spending and Taxes

What types of government programs are designed to improve economic inequity in the United States? Introduce your learners to government programs, such as low-income housing, Social Security, and Medicaid, how they work to improve...

Curated OER

Tax Jeopardy

Create a glossary of tax-related vocabulary and clip New York Times articles that present tax procedure in action, in preparation for participating in a tax quiz bowl. Young economists explore allegations that "Survivor" Richard Hatch...

Curated OER

Proportional Taxes

Students are able to define and give an example of a proportional tax and the impact that it can have on different income groups and explain how a proportional tax takes the same percentage from all tax groups.

Council for Economic Education

Preparing a 1040EZ Income Tax Form

Some of us never feel like we know how to do our taxes! Help scholars understand the process early by using an informative resource. They fill out their own tax forms in a simulation activity and view multiple resources to learn even...

Curated OER

Tax Forms and Deductions

Because many of your older students are probably getting their first jobs, it could be an appropriate time to discuss taxes. This presentation defines deductions, types of taxes, purposes of paying taxes, and the forms required to file...

Curated OER

Module 13-Electronic Tax Return Preparation and Transmission

Students explain the electronic preparation and transmission of tax returns. They describe the ways to prepare and transmit tax returns and explain the benefits of electronic tax return preparation and transmission.

Curated OER

Corporate Tax Rate and Jobs

Does lowering the corporate tax rate help create jobs in the United States? Learners explore the top pro and con arguments and quotes relating to the issue. They read background information about the creation of the federal corporate...

Virginia Department of Education

Sales Tax and Tip

Don't forget to tip your server. Future consumers learn how to calculate sales taxes and tips. Pairs use actual restaurant menus to create an order and determine the total bill, including taxes and tips.

Curated OER

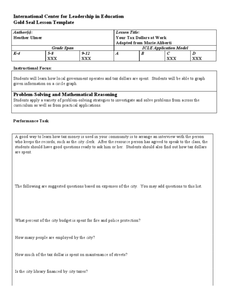

Your Tax Dollars at Work

In order to understand how tax dollars are spent, young economists use given data and graph it on a circle graph. Circle graphs are highly visual and can help individuals describe data. A class discussion follows the initial activity.

Visa

Financial Forces: Understanding Taxes and Inflation

Take the opportunity to offer your young adults some important financial wisdom on the way taxes and inflation will affect their lives in the future. Through discussion and review of different real-world scenarios provided in this...

Council for Economic Education

Tax Time Scavenger Hunt

Is a 1040EZ tax form really easy? Scholars investigate the complexities of the United States taxation system with an economics lesson. Using a wide variety of web sources, they interpret IRS taxation rules and regulations to better...

Curated OER

Understanding Tax: Your Role as a Tax Payer

Every adult should know that it is their responsibility to help fund public goods and services by paying taxes. Help young people get a handle on the history, evolution, purposes for, and reasons why they should pay taxes too.

Curated OER

Completing Simple Tax Forms

Twelfth graders practice filling out IRS 1040 EZ forms. They discuss various ways people pay taxes. They assess the importance of W-2 forms and apply skills using the IRS tax table to compute how much money is owed or returned.

Curated OER

Taxes and Social Security

Students practice filling out the United States Federal 1040EZ tax form and share examples in a class discussion. A written exam is provided to help assess cumulative comprehension.

Curated OER

Taxes in U.S. History: Tax Reform in the 1960s and 1980s

Students explain the content, purpose, and impact of the Tax Reform Acts of 1969 and 1986.

Curated OER

Fairness in Taxes: Progressive Taxes

Students define and give an example of a progressive tax. They explain how a progressive tax takes a larger share of income from high-income groups than from low-income groups. They examine taxation in other countries.

Curated OER

Preparing a 1040EZ Income Tax Form

What do you do at the end of the year when your W2 arrives? File a tax form! Show learners how they to can fill out a basic 1040EZ tax form and play their part as tax paying citizens. Monetary denominations are provided for filling out...

Curated OER

Churches and Taxes

Churches have been tax-exempt since the founding of America, but should they be? Pupils ponder the question as they browse the website in preparation for a class debate or discussion. They research the history of tax-exemption for...

Balanced Assessment

Sales Tax Table

Sales tax rates vary; do the math to find the right rate! Pupils use before tax amounts and after tax amounts to determine the tax rate. Rounding makes the task challenging.

EngageNY

Tax, Commissions, Fees, and Other Real-World Percent Problems

Pupils work several real-world problems that use percents in the 11th portion of a 20-part series. The problems contain percents involved with taxes, commissions, discounts, tips, fees, and interest. Scholars use the equations formed for...

Other popular searches

- World Taxes

- Income Taxes

- Federal Taxes

- Local Government and Taxes

- Local Government Taxes

- Paying Taxes

- Benefits of Taxes

- Compute Taxes

- State Taxes

- Local Taxes

- Filing Income Taxes

- Payroll Taxes