Federal Reserve Bank

The Story of the Federal Reserve System

Prevent the Federal Reserve System from becoming a dry topic for your middle and high schoolers by using an informative, engaging resource! The cartoon takes your class on a journey with aliens from the planet of Novus to observe the...

PricewaterhouseCoopers

Planning and Money Management: Financial Plan

More planning goes into a budget than a high schooler thinks. Here, they learn about the expected expenses and incomes, along with outside factors such as natural disasters. Learners prepare their own budget and adjust it based on the...

Federal Reserve Bank

It's Your Paycheck

Beyond reading and arithmetic, one of the most important skills for graduating seniors to have is fiscal literacy and responsibility. Start them on the right financial track with nine lessons that focus on a variety of important personal...

Federal Reserve Bank

So How Much Are You Really Paying for that Loan?

Loans are rarely provided without a cost. Pupils evaluate the high cost of using a payday loan or payday advance through discussion and worksheets, and finally work in groups to develop short public service announcements that outline the...

Federal Reserve Bank

Creditors’ Criteria and Borrowers’ Rights and Responsibilities

Discover what criteria creditors use for making loans (the 3 Cs of Credit), and impress upon your young adults the rights and responsibilities related to using credit. Pupils role play as individuals seeking or providing credit, as well...

Visa

Bank or Bust: Selecting a Banking Partner

Why shouldn't we just save all our money in our mattress? Couldn't our money disappear? Pupils discover the benefits of utilizing banks and credit unions for saving money, as well as how to evaluate different types of institutions by...

Visa

The Cost of College: Financing Your Education

With college tuition at an all-time high, high school students must consider the financial obligations of attending higher education, as well as the impact of college on future career opportunities. Pupils will complete worksheets,...

Curated OER

All About Aid

Begin this lesson by estimating the cost of a college education and comparing it to actual data. After reading an article, high school seniors discuss the processes of the college loan corporations. They listen to a lecture about how to...

Carolina K-12

The US Financial System

Here is a unique activity in which learners simulate operations of a fractional reserve banking system, ultimately gaining a better understanding of how banks work and process money creation through lending. It includes a Story of Banks...

Beyond Benign

Final Budget

Be sure you have enough money to build a house. The 14th lesson in a 15-part series teaches young learners to use checkbook registers. They write checks for the amounts they spend on various housing materials and keep track of spending...

Beyond Benign

All A Loan

When designing a house, it's important to know about percents. Through a series of three lessons, scholars first review percentages through an activity involving M&Ms and then apply that knowledge to calculate compound interest and...

Radford University

Money and Finance

Make the connection between money and exponential equations. Pupils continue financial lessons as they learn about compound interest in savings accounts. They extend the investigation of savings by looking at annuities, and then...

Radford University

Surviving the Month

Pupils create budgets based upon family expenditures. They determine what the monthly payments will be for buying a car and a house based on compound interest for the total amount.

ProCon

Student Loan Debt

Should college loan debt be easier to discharge in bankruptcy? Scholars sort through the top three pros and cons to decide for themselves in preparation for a class debate or discussion. Learners may also participate in an online poll to...

College Board

2003 AP® Macroeconomics Free-Response Questions Form B

Learners consider production possibilities using an authentic test question from College Board. Other questions include practicing supply and demand curves and examining the effects of inflation, employment, and other variables on a...

California Department of Education

College: Plan Well and Pay Less

They say you gotta pay to play, and postsecondary education is no exception! High schoolers learn how to research and analyze the cost of postsecondary education as well as the different ways to pay for schooling. Learners then work...

Council for Economic Education

Loan Amortization - Mortgage

When you buy a home for $100,000, you pay $100,000—right? On the list of important things for individuals to understand, the lesson presents the concept of interest rates and loan amortization using spreadsheets and online sources....

CK-12 Foundation

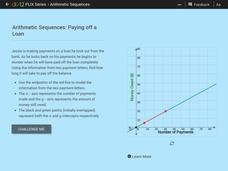

Arithmetic Sequences: Paying of a Loan

How long does it take to pay off a loan? Pupils use a graph to model the sequence associated with paying off a loan. Using the graph, learners determine the initial value and the common difference of the arithmetic sequence. The learners...

Federal Reserve Bank

Lesson 4: Back to School

Based on your current level of human capital, how long would it take you to earn $1,000,000? What about your potential human capital? Learners explore the importance of education and experience when entering the workforce, and compare...

EngageNY

End-of-Module Assessment Task - Algebra 2 (Module 3)

The last installment of a 35-part series is an assessment task that covers the entire module. It is a summative assessment, giving information on how well pupils understand the concepts in the module.

EngageNY

Buying a Car

Future car owners use geometric sums to calculate payments for a car loan in the 31st installment of a 35-part module. These same concepts provide the basis for calculating annuity payments.

North Carolina Department of Public Instruction

What Is A Bank?

You're never too young to learn about banking and personal finance. Use a set of seven banking lessons to teach middle schoolers about checking and savings accounts, interest rates, loans and credit cards, and safety deposit boxes.

Conneticut Department of Education

Personal Finance Project Resource Book

Balancing a budget, paying taxes, and buying a home may feel out of reach for your high schoolers, but in their adult years they will thank you for the early tips. A set of five lessons integrates applicable money math activities with...

Wells Fargo

Hands on Banking

Encourage middle schoolers to be proficient and knowledgeable in the economic world with a series of personal finance lessons. Focusing on banking, credit, budgets, and investing, the activities guide learners through financial literacy...